Take-Two Interactive Software (TTWO) set to report Q3 2026 earnings, a few points to note

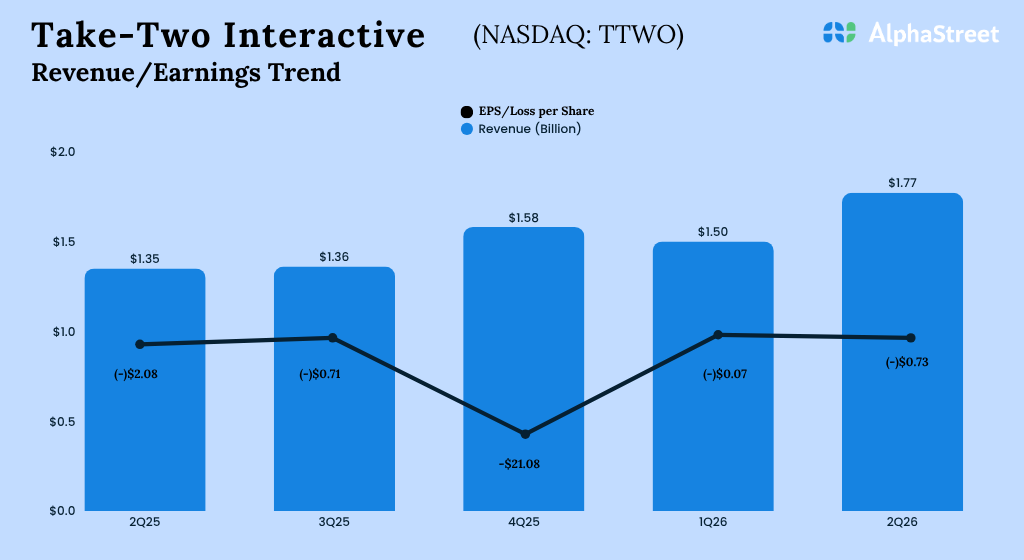

Take-Two Interactive Software (TTWO) is scheduled to report its Q3 2026 earnings on Tuesday, February 3, after market close. The company expects net revenues between $1.57-1.62 billion and a net loss of $0.49-0.35 per share. Key growth drivers include strong performance from new releases like NBA 2K26 and sustained mobile business strength, though recent stock performance has been impacted by concerns over new AI-powered competition.

https://news.alphastreet.com/take-two-interactive-software-ttwo-set-to-report-q3-2026-earnings-a-few-points-to-note/amp/