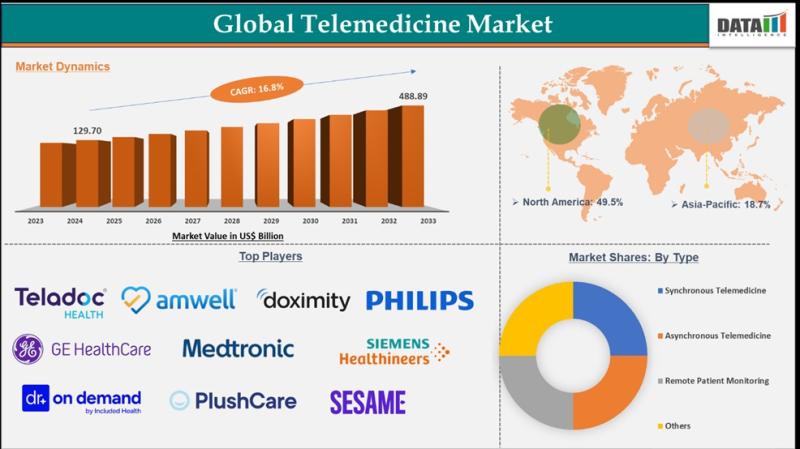

Telemedicine Market to Reach US$ 488.89 Billion by 2033 at 16.8% CAGR | North America Leads with 39% Share | Key Players Include Teladoc Health, Philips, GE HealthCare, Siemens Healthineers, American Well

The global telemedicine market is projected to grow significantly from US$ 129.70 billion in 2024 to US$ 488.89 billion by 2033, exhibiting a CAGR of 16.8%. This growth is fueled by increasing demand for remote healthcare, technological advancements, and supportive government policies. North America currently leads the market with a 39% share, while key players include Teladoc Health, Philips, GE HealthCare, Siemens Healthineers, and American Well.

https://www.openpr.com/news/4385979/telemedicine-market-to-reach-us-488-89-billion-by-2033-at-16-8