Best Stop Loss Strategies for Trading

A stop loss is a trading strategy used to limit potential losses in an adverse market movement. It is essentially an order placed to sell a security if its price falls to a certain level, known as the stop price.

For example, suppose a trader buys a stock at $60 and sets a stop-loss order at $55. The stop-loss order is triggered if the stock price falls to $55 or below. The trader’s shares will be automatically sold to limit the trader’s losses.

While stop-loss orders can help limit potential losses, they do not guarantee that losses will be limited to the specified stop price. In fast-moving markets or during periods of extreme volatility, the price at which the stop loss order is executed may be significantly different from the stop price, resulting in larger losses than anticipated.

The Importance of Stop Loss in Trading

Stop-loss orders are vital for risk management and preserving invested capital. They serve three key purposes in trading:

Firstly, they mitigate potential losses. By setting a predetermined price level, traders can limit downside risk if the trade goes against their expectations. So you can safeguard your capital from substantial losses. Remember that this is probably one of the most important things you can do:

“Avoiding a loss takes priority over improving gains. To make up for a 95% loss in value requires the investor to make an astounding gain of 1900%.”

Benjamin Graham

Secondly, stop-loss orders eliminate emotional bias. Fear and greed often cloud judgement, leading to impulsive decisions. Utilizing stop-loss orders ensures that traders adhere to their predetermined risk management strategy without being influenced by emotions.

Understand the Market You Are Trading

Not all markets are created equal; some are more volatile than others and have different price-action profiles. Understanding the market that you’re trading, along with its expected trading range, will help you place your levels effectively. Keep in mind the trading hours and whether the market could gap up or down at its opening (such as with stocks or futures).

Here is a great example of knowing the market you are trading. Below is the chart of Microstrategy (a stock heavily correlated with the cryptocurrency Bitcoin). This means that when Bitcoin goes up, the stock also goes up.

Imagine you entered a position for this stock on a Friday before the weekend because you heard some good news about Bitcoin and hoped the stock would go up, too. You did not really follow any news over the weekend because you knew that the stock market was closed over the weekend. Unfortunately for you, the crypto market is open 24/7 and Bitcoin crashed on the weekend. So, on Monday, at the opening bell, the stock price started to crash instantly.

That is why setting a stop-loss is crucial. You would probably gain a 50% loss if you would not have monitored and exited your position manually. With a stop-loss, however, your position would have been protected and closed before you had this massive loss. Remember, a stop-loss order is only triggered by the price threshold that you set; it doesn’t guarantee that your position is closed at the same price.

10 Tips for Setting a Stop Loss

Before we get into the best stop-loss strategies, we have prepared a small section for you that will get you started straight away. You can always come back to this section to get a quick overview of some general tips that you might consider when setting your stop loss.

- Percentage-Based Stops: This is the most common type. Traders might set a stop loss at a predetermined percentage from their entry point. For instance:

- 1-3% for more conservative traders or those with larger accounts.

- 5-10% for more aggressive traders or those with smaller accounts.

- Volatility-Based Stops: Some traders use the asset's volatility to set stop losses. The Average True Range (ATR) is a common tool for this. For example, a trader might set a stop loss at 2x the ATR below their entry for a long position.

- Technical Analysis Stops: Technical traders might set stop losses at specific levels based on chart patterns or indicators. For example, below a major support level or moving average.

- Time-Based Stops: If the trade doesn’t move in the desired direction after a certain amount of time, the position is closed.

- Dollar Amount Stops: Some traders decide on an absolute dollar amount they're willing to risk on a trade rather than a percentage.

- Be Consistent: Whatever method or percentage you choose, be consistent in its application.

- Always Use Stops: Almost all successful traders emphasize the importance of always using a stop loss.

- Avoid Moving Your Stop: It's generally advised not to move a stop loss further away after the trade is initiated. Moving stops can lead to larger losses than initially intended.

- Review and Adjust: If you're getting stopped out too often before the trade moves in your predicted direction, you may need to adjust your strategy or the level at which you set your stops.

- Consider the Bigger Picture: While managing the downside is essential, consider the potential upside of a trade. If your potential reward is much smaller than your risk, it might not be a trade worth taking.

Best Stop Loss Strategies

The best stop-loss strategies depend on a trader’s trading style, risk tolerance, and market conditions. Several effective stop-loss risk management strategies are summarized below.

Percentage-Based Stop Loss

A percentage-based stop loss involves setting a stop loss level based on a percentage decline from a current market price.

For example, if the trader buys a stock at $100 and sets a stop loss at 2% below the entry price, the stop loss level would be $98. So, if the stock price falls to $98 or below, the stop loss would trigger and the trader would exit the trade with a loss of $2.

Below is a real chart example of how to set a percentage-based stop-loss.

- We can see a live example on the Bitcoin chart in this case. We spot a Tweezer Tops pattern, indicating a potential reversal, and we Enter a Short position at around $27450.

- Now that we have the entry, we need to set a stop-loss. In our example, we will put a percentage-based stop-loss of 2%. So, to calculate the stop loss, we must take 2% of the entry price of $27,450, which is approximately $550.

Hence, we put our stop loss at $27,450 (Entry Price) + $550 (2%) = $28,000 (Stop Loss).

Support and Resistance-Based Stop Loss

Support and resistance levels are areas on a chart where the price has previously encountered buying or selling pressure and can act as potential levels for price reversals. Hence, setting a stop loss at this level is very popular among traders.

- If the trade direction is up (long), traders set a stop loss below the support level to protect against downside risk.

- If the trade direction is down (short), traders set a stop loss above the resistance level to protect against upside risk.

Below is an example of how to set a stop-loss at a support level.

- Assume that in this case, the new support area will hold, and we take a Long Entry after spotting a bullish Hammer Pattern.

- We want to put a stop-loss at the support level to protect against downward risk. Our support level is around the $28,700 level, so that is where we also put our stop-loss.

Unfortunately, the long position did not play out as intended. The trend did not continue and the price went in the opposite direction. Luckily, our stop loss got triggered at the support level, saving us from a huge loss. In this case, you would have only encountered a loss of around 1-2% instead of a potential loss of almost 15% if you sold at the bottom of the red candle. This is why setting correct stop-losses is so crucial.

Confluence Stop Loss

The confluence stop loss strategy involves using multiple indicators or analysis techniques to confirm a stop loss level. Such indicators may include moving averages, support and resistance levels, previous highs and lows, Fibonacci retracements, trendlines, and channels.

This strategy aims to increase the probability of the stop loss level being respected and minimize the chances of being stopped out due to a false signal.

Below is an example of how to set a stop-loss at a confluence level. We are using two technical indicators for setting our stop-loss analysis here: Bollinger Bands and MACD levels:

- Bollinger Bands measure price volatility by plotting a central moving average with two standard deviation bands above and below it.

- MACD (Moving Average Convergence Divergence) indicates trend momentum and potential buy/sell signals by comparing short-term and long-term moving averages.

- In this case, we are trading Bitcoin on the 5m chart. After spotting a bullish Tweezer Bottom, we make a Long Entry.

- Now, we have to set our confluence stop loss. That means taking at least two indicators to confirm the stop loss level. The candle needs to be (1) outside the lower Bollinger Band, and (2) the MACD has to be at its lowest point. So, from all the candles outside the Bollinger Bands, we take the candle where the MACD is at its lowest point. Then, we simply put the stop loss right below that candle, as shown above, with the purple line.

The great thing about using a confluence stop loss is that you use multiple indicators to find the correct level, giving you additional confidence. If you only used Bollinger Bands, you might have set the stop-loss to tight.

Volatility-Based Stop Loss

A volatility-based stop loss is a strategy that involves setting a stop loss level based on the volatility of the market. Volatility is a measure of how much the price of an asset fluctuates over a given period and can be calculated using a technical indicator such as Average True Range (ATR).

Below is a real chart example of how to set a volatility-based stop-loss with ATR.

- On this chart, we Enter a Long after spotting a potential Three White Soldiers pattern on this downtrend.

- Now, we need to set a proper stop loss. Due to the high volatility of Bitcoin, a volatility-based stop loss might be a good idea. But how would we put a 2x ATR volatility stop loss? (1) We take the Entry price, which is $26500. (2) We look at the ATR value at the entry at around 700. (3) 2x ATR means that we take the value times two, making our difference 2 x 700 = 1400. (4) Getting the value for our stop loss by subtracting Entry Price – 2x ATR, which is 26500 – 1400 = 25100. So, we set our stop-loss at $25,100.

Luckily, despite slight retracement, the trade played out nicely and our stop-loss was not triggered. Overall, the volatility-based stop-loss strategy effectively protects against downside risk and ensures that the trade remains protected. By setting the stop loss level based on the market's volatility, you can account for the fluctuations in price movement and minimize the chances of being stopped out due to a false signal.

Advanced Stop-Loss Tips

Study Your Positions

Taking your take-profit and stop-loss levels into account, think about the risk/reward ratio of your position. If you’re a seasoned trader, you should have a solid understanding of your own risk aversion. If you don’t, this is a great way of getting to know yourself as an investor and trader. Do you find yourself expecting 20%+ returns per trade but setting shallow stops? Where do you place your stop-loss usually? What trades keep you up at night?

It can be hard for some people to conceptualize risk-taking, but looking at your history of stops can help you learn much about yourself. As a rule of thumb, if you’re setting stop-loss levels and are still nervous about your trades – you’re trading outside your risk tolerance.

Watch Out for Round Numbers

Technical traders will have heard of the term “round-number support”, which refers to price levels that garner a lot of trading volume, especially around round numbers or integers. It’s a phenomenon where traders are more likely to buy or sell their investments when they’re trading at round numbers, partly because they are memorable. If you buy a stock at $23 and you see it break $30, that’s a very memorable round number, and you may consider closing your position. Keep these levels in mind when setting stop loss levels. Other trades will likely buy or sell at these levels, putting your position at risk, as it may get executed at an undesirable price when it encounters resistance or support.

Stop Hunting And How To Avoid It

This practice is employed by larger traders or institutions that have the power to manipulate the market in their favour. Stop hunting involves placing large volume orders to buy or sell at a price level that is close to the existing stop loss orders. When the price of the security eventually reaches this price level, the stop-loss orders are triggered. This causes a cascade of selling and buying that can drive the price further in the desired direction. In the end, stop hunting can be seen as a form of manipulation, where big sharks exploit the weaknesses of smaller traders for their personal gain. But what precautions can you take to avoid being stop-hunted?

- Monitor and adjust your stop loss in times of low liquidity or high volatility.

- Trade higher timeframes, as stop hunting is more common on lower timeframes.

- Avoid using too much leverage, as this could cause your stop loss to get triggered easily in a volatile market.

- Use a reputable broker, as some unscrupulous brokers engage in stop-hunting, especially in markets where they can take the opposite side of their clients' trades.

If you do not want to trust a particular broker's reputation, consider using Morpher. Firstly, Morpher is backed by the most reputable investors on the planet. Secondly, we have an Excellent rating on Trustpilot with hundreds of 5-star reviews. Thirdly, and most importantly, Morpher is completely transparent. We created a trustless trading platform that is entirely on-chain. We even open-sourced our code for our smart contracts so anyone can verify that it is indeed impossible for us to interfere with your trading activity.

Conclusion

Market understanding is a critical factor that affects a trader’s stop-loss strategy. These traders can set appropriate stop-loss levels and adjust their strategy based on market trends, reducing their overall risk. However, no stop-loss strategy is foolproof. Traders should choose a strategy that best fits their trading style and risk tolerance. Additionally, traders should be aware of stop hunting and the various ways in which it can be avoided.

Disclaimer: All investments involve risk, and the past performance of a security, industry, sector, market, financial product, trading strategy, or individual’s trading does not guarantee future results or returns. Investors are fully responsible for any investment decisions they make. Such decisions should be based solely on an evaluation of their financial circumstances, investment objectives, risk tolerance, and liquidity needs. This post does not constitute investment advice.

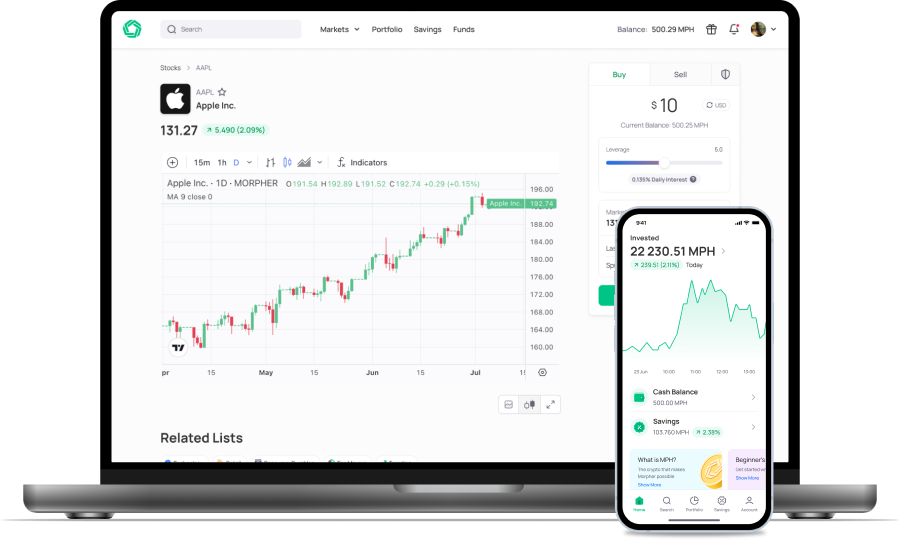

Painless trading for everyone

Hundreds of markets all in one place - Apple, Bitcoin, Gold, Watches, NFTs, Sneakers and so much more.

Painless trading for everyone

Hundreds of markets all in one place - Apple, Bitcoin, Gold, Watches, NFTs, Sneakers and so much more.