Cronos Group: Tobacco Cash, Cannabis Crossroads and a Stock Market in Waiting

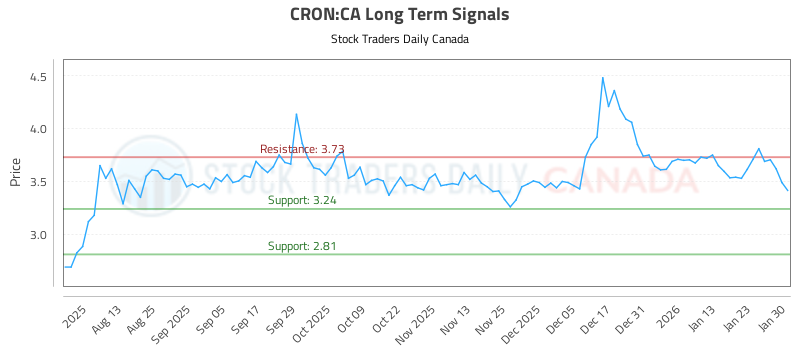

Cronos Group's stock has seen a decline recently, despite the company having substantial cash from Altria and no debt. Investors are trying to determine if the cannabis stock is an undervalued opportunity or a slow-moving trap, given its sluggish revenue growth juxtaposed with legalization hopes and cost-cutting efforts. Wall Street analysts remain cautious, with most issuing "Hold" ratings and modest price targets, awaiting clearer evidence of accelerated revenue growth or significant regulatory shifts to justify a more bullish outlook.

https://www.ad-hoc-news.de/boerse/news/ueberblick/cronos-group-tobacco-cash-cannabis-crossroads-and-a-stock-market-in/68547358