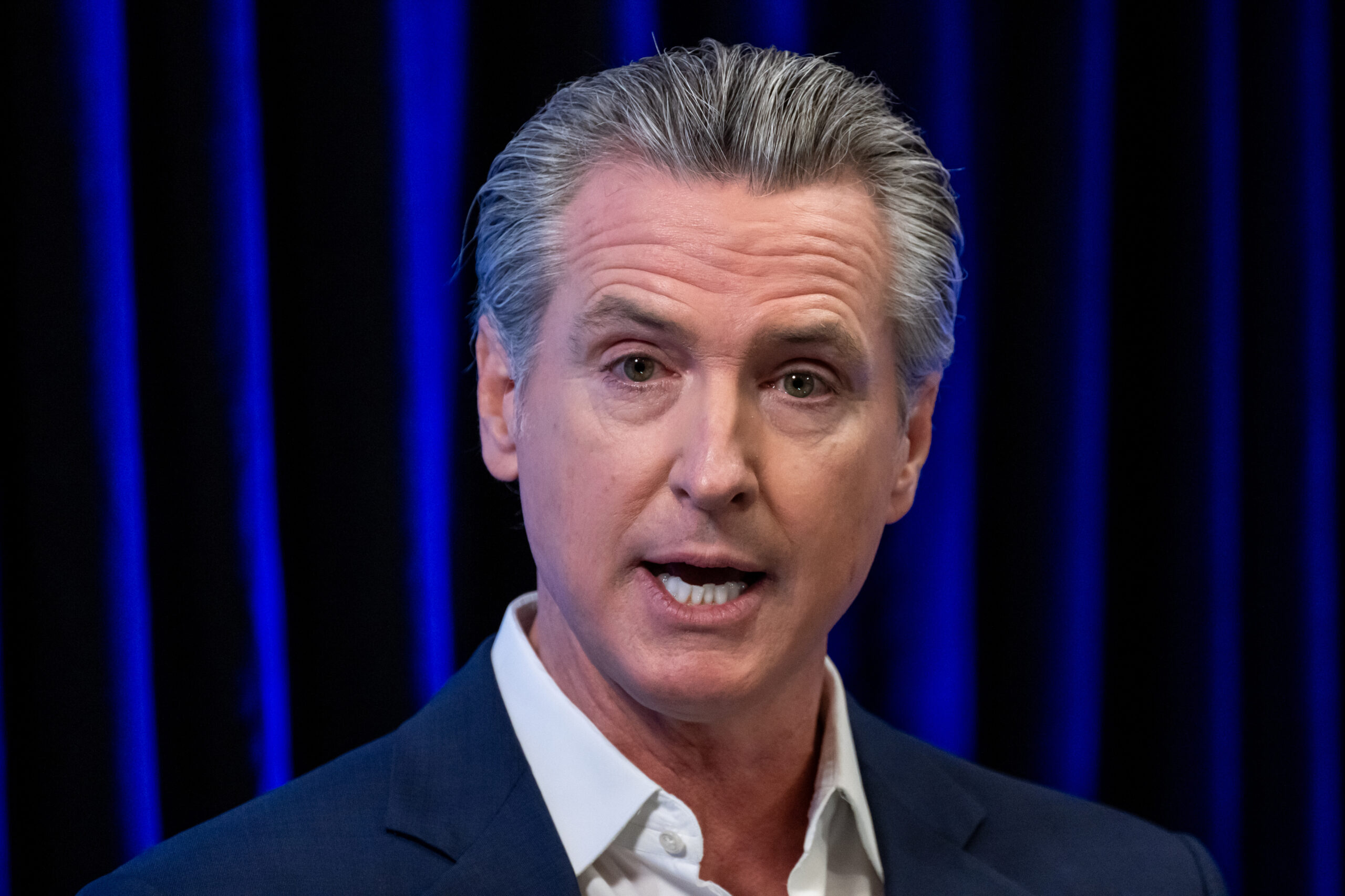

Governor ‘Not Convinced’ California Wants to Take Over PG&E

California Governor Gavin Newsom expressed skepticism about the state taking over PG&E Corp., despite recent criticisms regarding blackouts in San Francisco. Newsom highlighted that PG&E is a much different company since its bankruptcy, with executive pay now tied to safety metrics, and the state already has mechanisms to intervene if it fails to meet safety standards. While some local officials renewed calls for a takeover after holiday outages, Newsom indicated the state likely lacks the appetite for such a move, though he previously considered it during the company's 2019 bankruptcy restructuring.

https://www.insurancejournal.com/news/west/2026/02/04/856891.htm