Why (RGEN) Price Action Is Critical for Tactical Trading

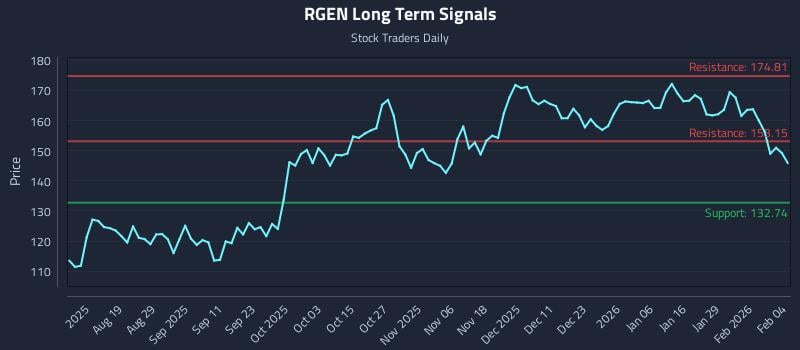

This article analyzes Repligen Corporation (NASDAQ: RGEN) stock, highlighting a weak near and mid-term sentiment despite a long-term positive outlook. It identifies a mid-channel oscillation pattern and an exceptional short setup with a 46.4:1 risk-reward ratio, targeting a 13.3% downside. Three distinct AI-generated trading strategies (Position, Momentum Breakout, and Risk Hedging) are provided, along with multi-timeframe signal analysis.

https://news.stocktradersdaily.com/news_release/52/Why_RGEN_Price_Action_Is_Critical_for_Tactical_Trading_020426105601_1770263761.html