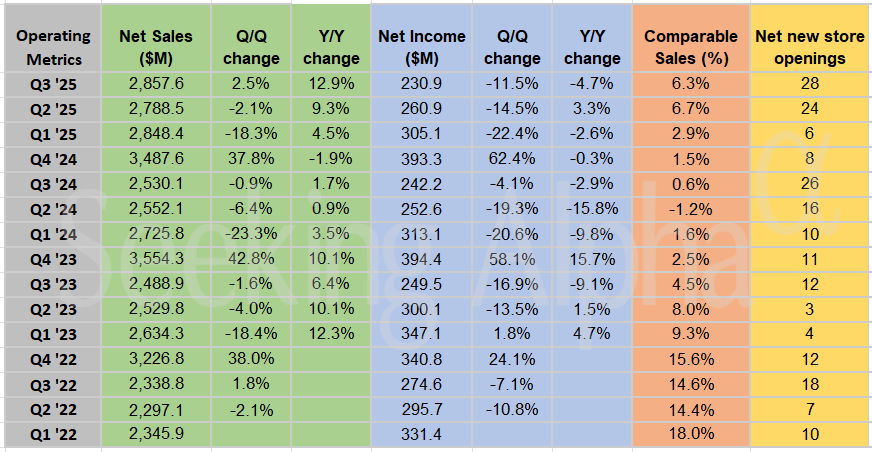

Ulta Beauty Q3 earnings smash estimates; comp sales jump 6.3%

Ulta Beauty Inc. reported strong third-quarter results, exceeding Wall Street expectations for both sales and earnings, driven by increased comparable sales and strategic acquisitions. The company raised its full-year sales and earnings outlook, with fragrance and skin care remaining the fastest-growing categories. Ulta continues to expand internationally, opening new stores in Mexico and Kuwait.

https://chainstoreage.com/ulta-beauty-q3-earnings-smash-estimates-comp-sales-jump-63