Auction Market Theory: The Forces Behind Market Movements

Auction Market Theory views financial markets as ongoing auctions where prices are set by buyer and seller interactions, similar to principles in Wyckoff Theory.

Auction Market Theory (AMT) and Wyckoff Theory are often discussed together because they share similarities in their approach to understanding market behavior through the lens of supply and demand, buyer and seller dynamics, and price discovery.

Wyckoff Theory, developed by Richard D. Wyckoff, emphasizes the roles of supply and demand, accumulation and distribution, and the phases of the market cycle. AMT builds on these principles by focusing on the auction process in markets, where the ongoing negotiation between buyers and sellers establishes price levels.

The Concept of Market Auctions

Markets operate on the principle of auctions, where the highest bid and the lowest ask converge to form a transaction. This auction process is influenced by the balance between supply and demand. Most of the time, markets are in a state of equilibrium, where supply meets demand, resulting in a high-volume range that represents fair value. However, when new information enters the market, this balance is disrupted, leading to periods of price discovery as the market seeks a new equilibrium.

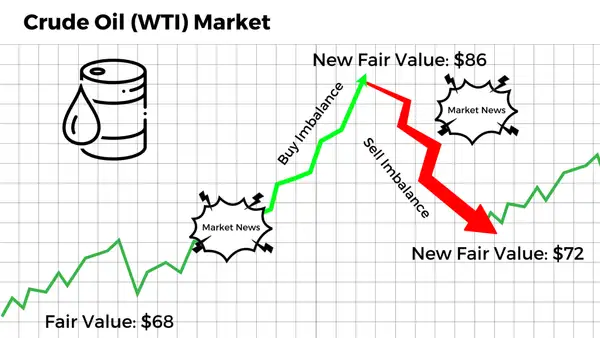

Imagine Crude Oil (WTI) trading steadily between $60 and $65 per barrel. This range represents a fair value where buyers and sellers agree on the price. A geopolitical crisis in an oil-producing region might then trigger a buying frenzy, pushing prices up to a new range of $75 to $80 per barrel.

- Initial Fair Value Area: Stable prices indicate balanced market conditions.

- Market Event: Geopolitical tension causes buying pressure, leading to a price spike.

- New Fair Value Area: Market finds a new balance after the initial spike.

- Market Event: Increased production causes selling pressure, leading to a price drop.

- Final Fair Value Area: Market stabilizes at a new balance.

Role of Supply and Demand Dynamics

The dynamics of supply and demand are crucial in Auction Market Theory. By analyzing the relationship between volume and price, traders can gauge the strength of these forces and predict potential market movements. For instance, in the oil and gas industry, high prices and strong financial positions in 2024 have led to significant investments in both traditional and low-carbon energies. Understanding these supply and demand shifts can help traders anticipate price changes and capitalize on emerging trends.

Key Players in the Market

Market participants play a vital role in Auction Market Theory, often classified into “strong-handed” and “weak-handed” traders.

Strong-Handed Market Participants: These traders, typically institutional, move large volumes and create significant market impacts. They tend to act at the boundaries of price balance, pushing the market towards new equilibria when these boundaries are broken.

Weak-Handed Market Participants: Often retail traders, they usually enter the market at the end of moves, buying at resistance and selling at support. These participants frequently get trapped, providing opportunities for strong-handed traders to reverse positions and exploit their stops.

Understanding Market Structure

Understanding market structure involves recognizing how prices move from balance to balance, with the following key structural rules:

- Prices within a balance range tend to stay within that range.

- Extremes of a balance are created by the actions of strong-handed traders.

- Prices escape a balance through extremes caused by strong-handed traders.

- Broken balance extremes act as support or resistance, preventing re-entry into the balance.

- A break of balance indicates market direction.

- Acceptance back into balance suggests a failed expansion, guiding future price movement.

Tools for Visualization

Auction Market Theory uses tools like Volume Profile and Market Profile to visualize market activity.

Volume Profile: This tool highlights areas of high and low volume, helping traders identify balance and imbalance. Key features include value areas, points of control, and high/low volume nodes.

Market Profile: This tool divides trading sessions into 30-minute intervals, using letters to represent each period. It helps traders identify initial balances, single prints, and tails, providing insights into market sentiment and potential trend directions.

Criticisms and Limitations

Despite its benefits, Auction Market Theory has limitations and criticisms. It does not provide precise predictions but offers valuable insights into market dynamics. Implementing AMT can be complex, requiring a deep understanding of the theory and the use of complementary analytical tools.

Conclusion

Auction Market Theory is a powerful framework for understanding market dynamics. By analyzing buyer and seller interactions, it provides valuable insights into price movements, enhancing trading decisions and risk management. While it has limitations, AMT remains a vital tool for serious traders. Incorporating recent market developments, this guide offers a comprehensive overview of Auction Market Theory, demonstrating its practical applications in today’s financial markets.

FAQ

What is Auction Market Theory?

Auction Market Theory is a framework for analyzing market activity based on the interactions between buyers and sellers. It provides insights into price discovery, market structure, and trading opportunities.

How can Auction Market Theory be applied in trading?

Auction Market Theory can be applied in trading by analyzing market profiles, recognizing patterns, and understanding the concepts of supply and demand. It assists in predicting market trends, managing risk, and identifying areas of interest for trading opportunities.

What are the limitations of Auction Market Theory?

Auction Market Theory faces limitations in providing precise predictions of future market movements. It also requires a deep understanding of market dynamics and the interpretation of various indicators. Traders should use it in conjunction with other analytical tools for optimal results.

Unlocking the secrets of Auction Market Theory is a journey that requires continuous learning and practice. By understanding its principles, applying it in real-world trading scenarios, and acknowledging its limitations, you can navigate the dynamic financial markets with more confidence and make better-informed trading decisions. Remember, combining Auction Market Theory with other analytical tools can enhance your trading edge and help you unlock profitable opportunities.

Ready to put Auction Market Theory into practice and revolutionize your trading experience? Look no further than Morpher, the cutting-edge platform where you can trade with zero fees, infinite liquidity, and up to 10x leverage. Whether you're interested in stocks, cryptocurrencies, forex, or even niche markets like NFTs and sneakers, Morpher's blockchain technology allows for fractional investing and short selling across a wide range of assets. Take control of your investments with the secure Morpher Wallet and enjoy a unique trading experience with Virtual Futures. Sign Up and Get Your Free Sign Up Bonus today to start trading the Morpher way!

Disclaimer: All investments involve risk, and the past performance of a security, industry, sector, market, financial product, trading strategy, or individual’s trading does not guarantee future results or returns. Investors are fully responsible for any investment decisions they make. Such decisions should be based solely on an evaluation of their financial circumstances, investment objectives, risk tolerance, and liquidity needs. This post does not constitute investment advice.

Painless trading for everyone

Hundreds of markets all in one place - Apple, Bitcoin, Gold, Watches, NFTs, Sneakers and so much more.

Painless trading for everyone

Hundreds of markets all in one place - Apple, Bitcoin, Gold, Watches, NFTs, Sneakers and so much more.