Crypto Shorting: How to Thrive in Bear Markets

Market crashes are an inevitable aspect of market dynamics, both in traditional markets like forex and stocks, but also in the crypto markets. A bear market in the crypto space can last for several months and cause prices to decline rapidly, as seen in the crypto market crash of 2022. During such a market condition, if an investor chooses to simply hold on to their investments, the value of their portfolio is likely to experience a significant decline.

Market crashes are part of the natural development of markets, whether it be in traditional markets or the crypto markets. A bear market in crypto can last for several months, sometimes even years, and cause prices to drop sharply. If you decide to just hodl during a bear market, you’ll most likely experience a steep drop-off in the value of your investments.

Short selling, also known as crypto shorting, is a strategy that allows traders to profit from market downturns.

To effectively use this technique, it’s important to have a thorough understanding of how it works and when to use it. This article will provide you an in-depth look at crypto shorting, including tips and what are the risks involved.

Crypto Shorting: How it Works

When shorting crypto, a trader borrows a cryptocurrency and sells it on an exchange at the current market price. The trader then waits for the price of the cryptocurrency to decrease, at which point he/she buys back the same amount of the cryptocurrency at a lower price and returns the borrowed amount to the lender, along with an interest fee which usually applies when borrowing. The trader keeps the difference between the sale and purchase price as profit (minus the interest).

Here’s an example to better understand how it works:

Let’s assume that Bitcoin is trading at $50,000 and you want to short Bitcoin because you believe the price will decrease in the near future and want to profit from the downturn. First, you borrow one Bitcoin at a fixed interest per annum (interest varies across different platforms). For the sake of this example let’s assume that our interest rate is 10%.

After one year, the price of Bitcoin drops to $20,000 and you want to close your position. You would have to buy back one Bitcoin for $20,000, return it to the lender, pay $5,000 (10% of $50,000 borrowed) interest fee and keep the rest of $25,000 as profit.

Understanding Crypto Bear Markets

A bear market is a market condition characterized by a prolonged decline in the value of investments, typically defined as a drop of 20% or more from recent highs. During a bear market, traders tend to be pessimistic and lack confidence in the market. So, their first reaction is to sell even more hastily, plummeting the market value further.

Eventually, as prices drop and become more attractive, traders will begin buying again, ultimately signaling the end of the bear market. To keep on top of all the news in the crypto sphere, you might want to listen to crypto podcasts to stay updated.

There are several factors that can contribute to a crypto bear market:

Financial Crisis

In general, when the global economy is facing a financial crisis, investors tend to become more risk-averse and choose safer assets in order to protect their investments. This can lead to a decline in the demand for riskier assets like cryptocurrencies.

During an economic crisis traders may be more likely to liquidate their crypto holdings in order to raise cash to meet their financial obligations, causing a sell-off in the crypto market.

Regulatory Concerns

Regulations that directly impact the crypto industry, such as restrictions on trading or taxation, can lead to a decrease in demand for cryptocurrencies. For example, if a government imposes strict regulations on crypto exchanges, it can make it harder for individuals and businesses to buy and sell cryptocurrencies, which can decrease demand for them.

Regulations can also have a positive impact on the crypto market by providing greater oversight, protection for traders and legitimacy for the industry. However, when regulations are viewed as negative or restrictive, it can contribute to a bear market.

Collapse Of Key Players in The Crypto Space

The collapse of key players in the crypto space can also contribute to a bear market by causing a decrease in liquidity and even a market crash. This can happen when a large cryptocurrency exchange or project fails, as seen in recent cases such as the fall of Terra Luna in May 2022 and the implosion of FTX in November 2022.

The aftershocks of these failures can cause panic selling and further impact to the market. The crypto market overall is highly dynamic and complex, and the failure of one or a few key players in the system doesn't necessarily mean a complete market collapse. But it can have a significant impact on market sentiment to lead to a bear market.

How to Profit from Short Selling

Now that we covered the basics of crypto shorting, we can move on to exploring some strategies on how to short crypto.

Identifying overvalued coins

Identifying overvalued coins is a more complex technique that traders use to profit from market inefficiencies. The goal with this strategy is to find coins that are trading at prices that are higher than their intrinsic value, and then short selling them for a profit.

To identify overvalued coins, professional traders use a variety of technical and fundamental analysis tools. Technical analysis is all about studying candlestick charts, past price and volume data to identify repeatable patterns and make trading decisions based on those factors. Fundamental analysis, on the other hand, is the study of a coin's underlying economic, financial, and other qualitative and quantitative factors to determine its intrinsic value.

Using technical analysis

Technical analysis involves examining past prices and trend data to predict future market tendencies. It is based on the fundamental principle that price movement is not random and that market fluctuations are both observable and predictable.

Given that crypto markets are cyclical, historical trends can often be expected to repeat themselves. Here are some examples of charting tools and indicators to identify patterns and trends in the price of a coin:

Candlestick charts: Candlestick charts are used to identify patterns which can signal a downward price move in the markets. Some of these patterns include:

Bearish Engulfing Pattern: This pattern occurs when a small bullish candlestick is followed by a larger bearish candlestick that completely “engulfs” the previous candlestick. This can signal a bearish reversal in the market.

Shooting Star: This is a bearish reversal pattern that forms after a bullish trend. It's a single candlestick pattern that has a small body, a long upper shadow and little or no lower shadow.

Bearish Harami: This pattern signals a potential reversal and is formed by a large bullish candlestick followed by a bearish candlestick whose body is completely contained within the body of the previous bullish candlestick.

It's worth noting here that even though these patterns are considered bearish, they do not guarantee a profit. You should always consider the context of the market, the trend and other indicators to help you make the right decisions.

Moving averages: Moving averages are used to spot long-term trends and potential support and resistance levels. For example, if a coin's price is trading below its 200-day moving average, it may indicate a downtrend.

Fibonacci retracement: Fibonacci retracement levels are used to identify potential levels of support and resistance in a coin's price. In a downtrend, if the coin's price reaches a key Fibonacci level and fails to break through, it may indicate a trend continuation.

Relative Strength Index (RSI): RSI can be used to identify overbought or oversold conditions in a coin's price. An RSI above 70 is considered overbought, while an RSI below 30 is considered oversold.

Using fundamental analysis

Fundamental analysis is a method used to determine the intrinsic value of a cryptocurrency. It’s all about evaluating a coin's underlying economic, financial, and other qualitative and quantitative factors to determine its true worth. This is in contrast to technical analysis, which looks at charts and technical indicators to predict future market movements.

A good way to get started with fundamental analysis is to look at three main metrics: project metrics, financial metrics, and on-chain metrics.

Project metrics refer to the underlying technology and fundamentals of the coin. This includes its use case, the team behind the project, the coin's whitepaper, and its overall vision. All these factors can give a good understanding of the coin's potential for growth and if it's worth investing in it.

Financial metrics provide insight into the coin's financial health, including its revenue, expenses, and overall financial performance. This is where you’ll dive deeper into financial statements, such as its balance sheet, income statement, and cash flow statement. These insights are important when analysing the financial stability of a crypto project and its potential for long-term growth.

On-chain metrics refer to the coin's activity on the blockchain. On-chain analysis is a technique used to evaluate market sentiment by analyzing metrics such as the number of active addresses, transaction volume, market cap. These metrics can provide insight into the coin's adoption and usage, which can be an indication of its overall value.

For example, if a token has low trading volume and a large portion of its circulating supply is held by a small number of large holders, referred to as “whales”, it may be an indication that the coin's value is not widely supported and could be a risky investment.

Short Crypto on Morpher

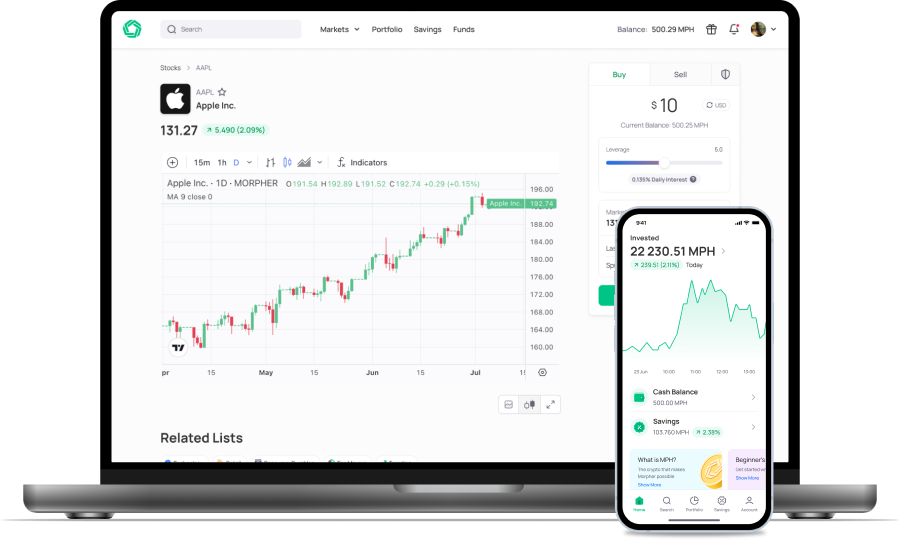

Shorting an asset on Morpher is really easy. Just enter the amount you want to invest in your short, and click “Short Sell”.

Why shorting on Morpher?

It is more cost-effective. Traditional short-selling with a broker or exchange requires borrowing the asset being sold, which often comes with fees. On Morpher, there are no borrowing fees, allowing you to short without any additional costs.

No maintenance margin. When shorting on Morpher, there is no maintenance margin requirement. This means that there is no requirement for traders to maintain a certain level of margin in their account in order to keep their short position open.

This is different from traditional platforms where traders are required to maintain a certain level of margin, otherwise their short position(s) will be closed automatically (“liquidated”) by the broker.

Infinite liquidity. Morpher eliminates the problem of insufficient buyers and sellers in the market. This makes it easier to enter and exit short-selling trades, avoid slippage fees and slow order processing.

24/7 trading. Morpher allows for trading 24/7, whereas most platforms do not. On Morpher you can short crypto with just $1 on a lazy Sunday afternoon.

Conclusion

In conclusion, short selling can be a valuable tool for traders looking to profit from a falling market. However, because the crypto market is often highly volatile and has sudden price movements, it's essential to have a deep understanding of the market and the underlying assets before attempting to short crypto.

Disclaimer: All investments involve risk, and the past performance of a security, industry, sector, market, financial product, trading strategy, or individual’s trading does not guarantee future results or returns. Investors are fully responsible for any investment decisions they make. Such decisions should be based solely on an evaluation of their financial circumstances, investment objectives, risk tolerance, and liquidity needs. This post does not constitute investment advice.

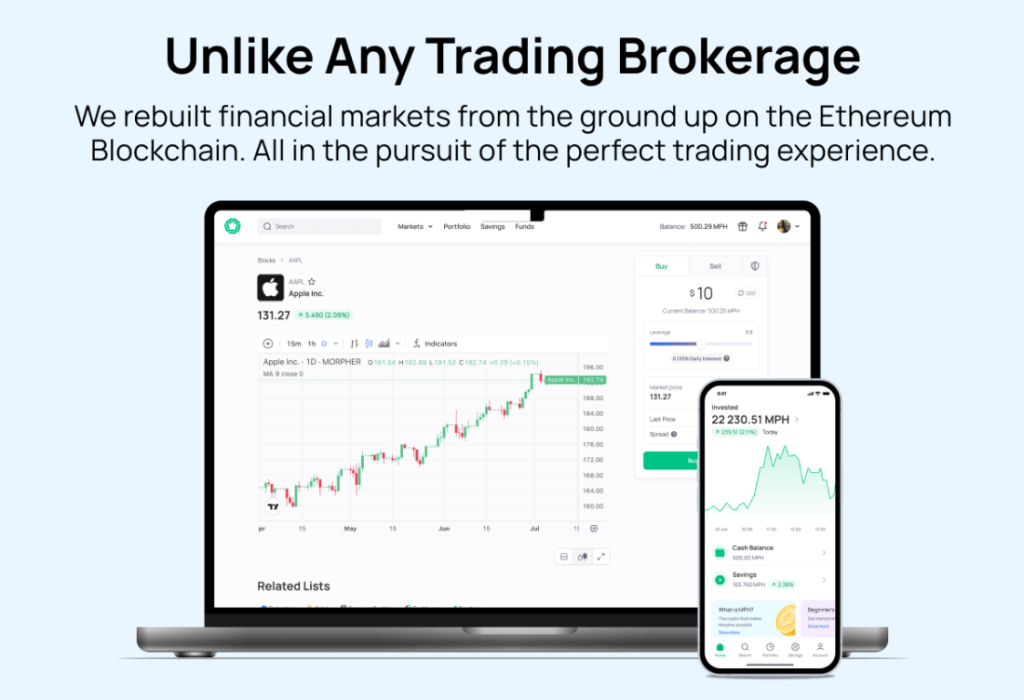

Painless trading for everyone

Hundreds of markets all in one place - Apple, Bitcoin, Gold, Watches, NFTs, Sneakers and so much more.

Painless trading for everyone

Hundreds of markets all in one place - Apple, Bitcoin, Gold, Watches, NFTs, Sneakers and so much more.