Crypto Bear Market Strategies

Bear markets in the world of cryptocurrency are almost seen as a cultural phenomenon, a rite of passage for those who dare to invest in this wild and unpredictable market. Surviving a bear market is like a badge of honor, a mark of distinction that separates the veterans from the newcomers who joined during a bull run. When the newcomers experience a possibly devastating bear market, the veterans look upon them with a sense of knowing, as if to say, “First time?“.

For those who have been through a bear market before, losing a big chunk of their portfolio is nothing new. They put on their “McDonalds-Hat” and go to work, determined to earn more money to invest for the next bull run. To them, it's all part of the game. But for those who are new to the crypto market, a bear market can be a terrifying and confusing experience.

But remember, in the end, the next bull run always comes, so it's important to develop effective strategies for surviving and thriving during a bear market. In this article, we'll explore some of the key strategies that can help you navigate the ups and downs of the crypto market, whether you're a seasoned veteran or a wide-eyed newcomer.

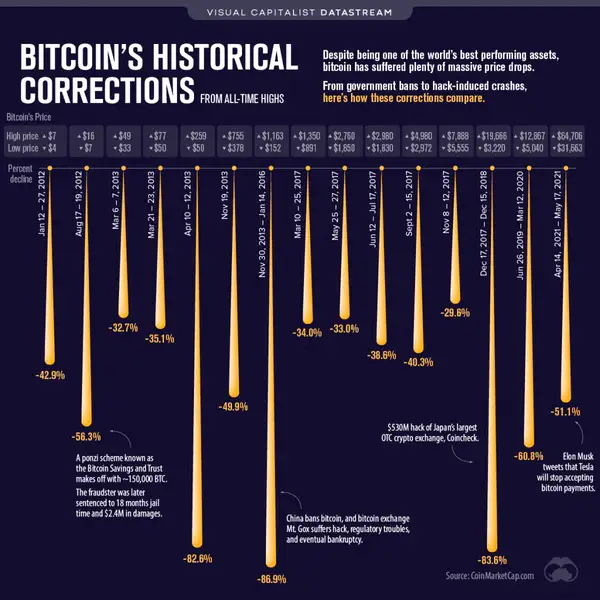

So, what is a bear market, really? It's a period of prolonged price declines, often characterized by a drop of 20% or more from recent highs, accompanied by widespread pessimism and negative investor sentiment. But in crypto, 20% drops are a bad Wednesday. We've seen market drawbacks of 80% or more in the past. So, how do you know whether it's a bear market? A journalist from Bankless stated that it's all about how it feels to you; if it feels like a bear market, act accordingly.

“And in my degen niche of crypto, I've noticed a tangible retraction in enthusiasm. People are less willing to take risks with small-cap tokens or ape into new NFT projects. Instead, more are converting their tokens into ETH/BTC or stables.”

Crypto Market Cycles

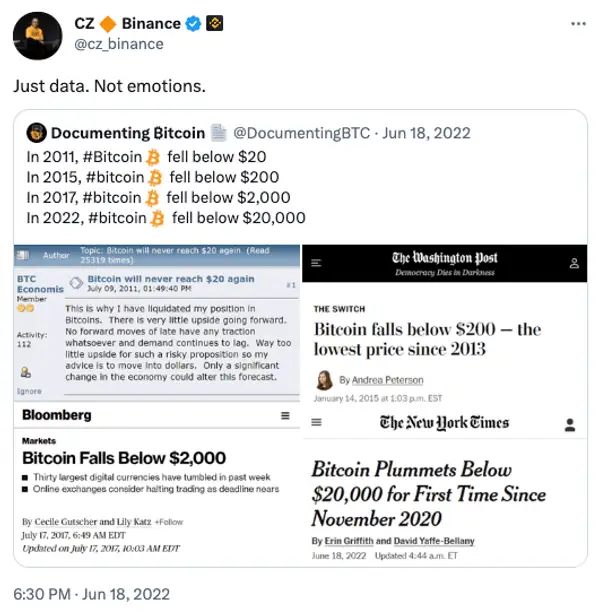

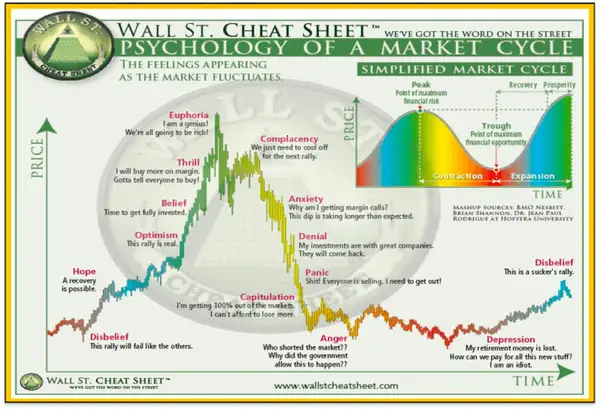

To truly understand this market, you must understand its cyclical nature. There are four primary phases that these crypto market cycles follow: accumulation, markup, distribution, and markdown. Each phase is marked by distinct changes in the market, driven by the psychology of investors.

During the accumulation phase, the market is quiet, and prices are low. This presents an opportunity for savvy investors to accumulate assets at a discount. As prices begin to rise and momentum builds, the market enters the markup phase, during which prices can experience significant growth. This is the time to ride the wave and maximize profits.

However, as prices reach their peak, the distribution phase begins. Savvy investors begin to sell off their holdings, taking profits and preparing for the inevitable decline. Finally, during the markdown phase, prices begin to decline as more investors exit the market. This is when the bear market takes hold, and it can be a tough time for investors.

There are also other market cycles used, with even more different parts to the equation. If you are completely new to all of this, sometimes it is better to follow some investors with a proven track record that will give you some insights into where the market is.

Understanding these cycles is key to developing successful investment strategies in the crypto market. As we enter into a new bear market, it's important to remember that this phase may be related to the end of the previous markup phase and the beginning of a new accumulation phase. Keep your eyes open, and don't be afraid to take advantage of the opportunities that present themselves during these cycles. The cryptocurrency market is never boring, but with a little knowledge and some well-timed investments, you can come out ahead.

How Long Do Crypto Bear Markets Last

The crypto market has seen its fair share of bear markets, and they can be long and grueling. In fact, some of the longest bear markets in crypto history have lasted for over a year. The 2013 to 2015 bear market holds the record for the longest, clocking in at a staggering 633 days. But don't let that discourage you, as the market has bounced back from even the harshest bear markets in the past. From 2018 to 2019, we saw another bear market lasting 361 days, and more recently, the 2021 to 2022 bear market lasted 260 days, making it the second-longest on record.

It's important to remember that bear markets are a natural part of the market cycle, so enjoy the ride and use it as an opportunity to set yourself up for the next bull market.

Crypto Bear Market Strategies

Bear markets are opportunities for smart investors to accumulate assets that will yield outsized returns during the next bull run. In a bear market, the goal is to survive and minimize losses, not to grow the portfolio. It's important to keep things simple and trust in long-term strategies that will be stress-tested during the downturn.

HODLing

When the bear market comes, many investors panic and sell off their holdings, but the simplest strategy, and one that most investors resort to, is HODLing. HODLing is not about timing the market but about time in the market. It's about believing in the long-term potential of your assets and having the discipline to stick with them through the ups and downs. In a bear market, the temptation to sell can be strong, but those who HODL through the storm may reap greater rewards when the next bull market arrives. So, if you're a long-term believer in the crypto market, consider the good n old “HODLing” strategy and hold on tight.

Probably the most notorious holder of all time is Microstrategy and Michael Saylor, who are only buying and holding, still set out to be seen selling a Bitcoin.

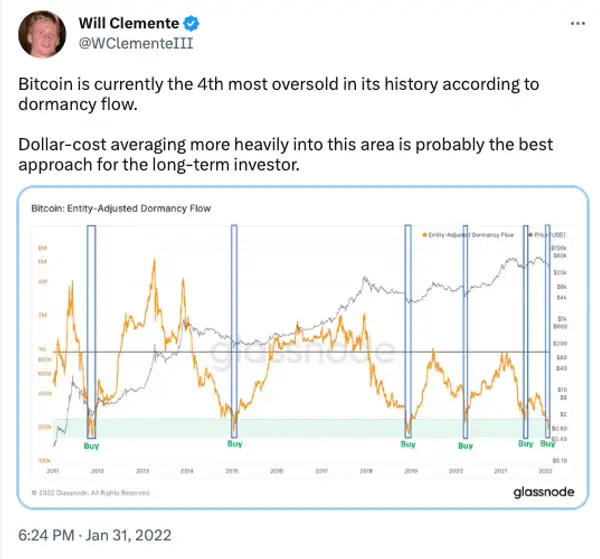

Dollar-cost Averaging

Dollar-cost averaging (DCA) is a strategy where you invest a fixed amount of money regularly over a long period of time, regardless of the market conditions. This approach allows investors to buy more crypto during dips and less during price spikes, averaging the cost over time. DCA is a great strategy for new investors who want to enter the market gradually without the risk of buying at a market peak. It is also a way to remove emotions from investing decisions and stick to a long-term plan.

For example, let's say you want to invest $10,000 in a particular cryptocurrency. Instead of investing it all at once, you could plan to invest $1,000 every month for 10 months. This way, you'll buy more when prices are low and less when prices are high. And because you're investing regularly, you don't have to worry about timing the market perfectly.

“The only problem with market timing is getting the timing right.”

Peter Lynch

In the end, dollar-cost averaging may not be the flashiest or most exciting investment strategy out there. But it's simple, effective, and proven to work over the long term for retail investors. So if you're looking for a reliable way to weather the storm of a bear market, look no further than dollar-cost averaging.

Shorting and Technical Analysis

Shorting in bear markets can be an alluring proposition for those seeking quick and profitable gains. As evidenced, significant sell-offs often occur over days or weeks, presenting opportunities for savvy investors to profit from short selling.

Candlestick patterns and technical analysis are useful tools for investors to determine the future direction of the market, especially during a bear market. When a bear market is confirmed, investors can use technical indicators to spot potential entry and exit points, as well as to set stop-losses to minimize losses in the event of unexpected price movements.

Candlestick patterns are particularly helpful in identifying market trends and potential reversal points. For instance, a bearish engulfing pattern can signal that the market sentiment has turned bearish, which could be a good entry point for short crypto positions. On the other hand, a bullish engulfing pattern may suggest a bullish trend, indicating a good time to open long positions.

While candlestick patterns and technical indicators can provide helpful signals for investors, it is important to keep in mind that no strategy is foolproof, and unexpected market movements can still occur. It is also essential to use proper risk management techniques, such as stop-losses, to limit potential losses. Remember, crypto shorting can be a profitable adventure, but it's not for the faint of heart.

Conclusion

As some would say, the crypto bear market is a necessary evil that every crypto investor must face at some point. It's like the rite of passage for crypto traders, separating the weak hands from the diamond hands. Use the strategies we provided, protect your losses, and you will come out of it wiser and stronger, positioned to reap the benefits of the next bull run. Remember, in a bear market, your goal is to survive and not necessarily to profit, as recapped in this great video by Bankless. So keep it simple, stay calm, dollar-cost average, short, or just HODL.

Disclaimer: All investments involve risk, and the past performance of a security, industry, sector, market, financial product, trading strategy, or individual’s trading does not guarantee future results or returns. Investors are fully responsible for any investment decisions they make. Such decisions should be based solely on an evaluation of their financial circumstances, investment objectives, risk tolerance, and liquidity needs. This post does not constitute investment advice.

Painless trading for everyone

Hundreds of markets all in one place - Apple, Bitcoin, Gold, Watches, NFTs, Sneakers and so much more.

Painless trading for everyone

Hundreds of markets all in one place - Apple, Bitcoin, Gold, Watches, NFTs, Sneakers and so much more.