ICT Trading Strategy: Your Complete Masterclass on ICT Basics

Success in trading often hinges on understanding how the big players—the institutions—move the market. Few know this better than Michael Huddleston, also known as the Inner Circle Trader (ICT). With over 25 years of trading experience, Huddleston has built a reputation for pulling back the curtain on institutional trading tactics, especially in how banks and hedge funds manipulate price action. What sets him apart is his approach to teaching these strategies, blending deep analysis with an emphasis on price manipulation and liquidity, the invisible forces that drive market behavior.

Huddleston’s rise in the trading community wasn’t conventional. After experiencing his own struggles in the market, he dedicated years to understanding how institutional traders manipulate price to trigger stop losses, create false breakouts, and move prices in their favor. This intense focus led him to develop the ICT trading strategy, a system designed to help retail traders recognize these tactics and trade alongside the institutions.

In this article, we’ll take a deep dive into the ICT Trading strategy, breaking down its concepts, methods, pros, and cons, and even comparing it to the Smart Money Concepts (SMC) strategy. By the end, you’ll have a clear understanding of how to incorporate these powerful strategies into your trading and make more informed decisions.

Concept of ICT Trading

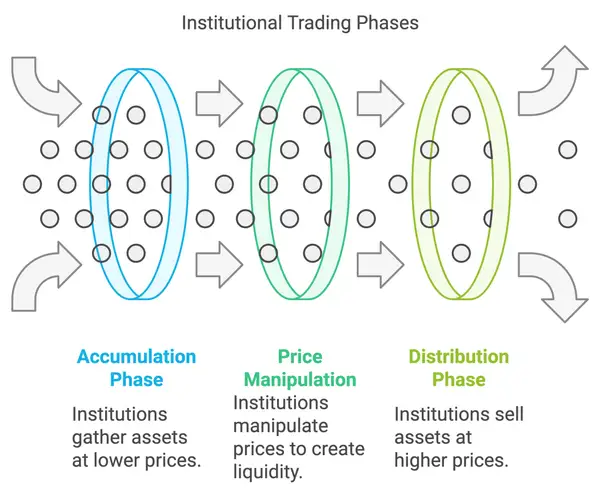

ICT trading is built on the premise that financial markets are driven by institutional traders—often referred to as the “smart money.” Retail traders frequently fall victim to price manipulation set by these large entities. ICT trading strategies are designed to help retail traders recognize these manipulation patterns, allowing them to enter and exit trades in line with institutional moves.

Core Idea: The market operates in phases of accumulation and distribution, where institutional traders manipulate price to create liquidity. ICT traders aim to identify these phases, positioning themselves to profit when institutional money makes its move.

Key Elements of ICT Trading

Order Blocks: These are price zones where institutions have placed large buy or sell orders.

Liquidity Zones: Areas where retail traders' stop losses are often concentrated, which institutions target before moving price.

Smart Money Footprints: Recognizing where large players enter the market by observing price behavior during specific sessions (e.g., London and New York).

Methods Used in ICT Trading

ICT trading employs several unique methods to analyze and trade the market, focusing heavily on institutional price movements. Some key methods include:

1. Market Structure Analysis

Traders analyze how the market transitions between bullish and bearish phases, identifying key support and resistance zones where institutional traders enter and exit positions.

2. Liquidity Pools

ICT traders learn to spot areas of liquidity, where large numbers of stop-loss orders are placed. These areas act as magnets for price manipulation by institutional players. Once liquidity is taken out, ICT traders look for opportunities to trade in the direction of institutional flow.

3. Time and Price Theory

This method focuses on the importance of specific trading sessions, such as the London open or New York open, when institutional traders are most active. ICT traders place their trades during these key times to align with the market’s major moves.

4. Risk Management Strategies

ICT emphasizes strict risk management by using narrow stop losses based on institutional price zones, combined with favorable risk-to-reward ratios. This ensures that even small trades can yield significant gains if executed correctly.

Pros and Cons of ICT Trading

Pros:

Alignment with Institutional Movements: ICT strategies focus on trading alongside the smart money, reducing the chance of being caught in false moves.

Precision: By identifying key zones like order blocks and liquidity pools, ICT traders can achieve highly precise entries and exits.

Adaptability: ICT strategies can be applied across various asset classes (stocks, forex, crypto), making them versatile.

Risk Management: ICT emphasizes strict risk control, minimizing losses on unsuccessful trades.

Cons:

Steep Learning Curve: ICT strategies involve complex concepts that require deep understanding and practice before they can be applied effectively.

Time-Consuming: The strategy relies on waiting for specific market setups, meaning you might need to wait for hours or even days for the right opportunity.

Overcomplication: Some traders may find the detailed analysis of order flow, liquidity, and timing overwhelming.

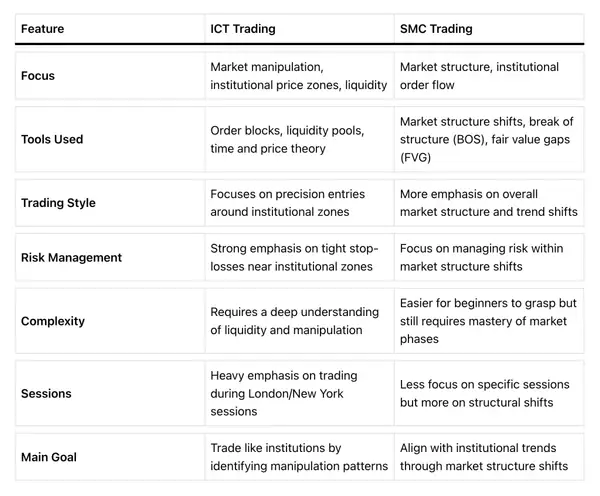

ICT Trading vs. Smart Money Concepts (SMC)

Both ICT and SMC strategies revolve around understanding and trading in sync with institutional money, but they approach this in slightly different ways. Here’s a comparison:

Develop and Implement Your Own ICT Trading Strategy

With your strategy defined and your tools in hand, it's time to put your plan into action. Here's a step-by-step guide to help you implement your ICT trading strategy:

- Perform thorough market analysis to identify potential trading opportunities. This includes analyzing market structure, support and resistance levels, and candlestick patterns.

- Set clear entry and exit rules based on your strategy. This involves defining specific price levels for entering or exiting trades, as well as incorporating risk management principles.

- Execute trades according to your predetermined rules. Stick to your plan and avoid making impulsive decisions based on emotions or short-term market fluctuations.

- Regularly review and analyze your trades to identify areas for improvement. This allows you to refine your strategy over time and adapt to changing market conditions.

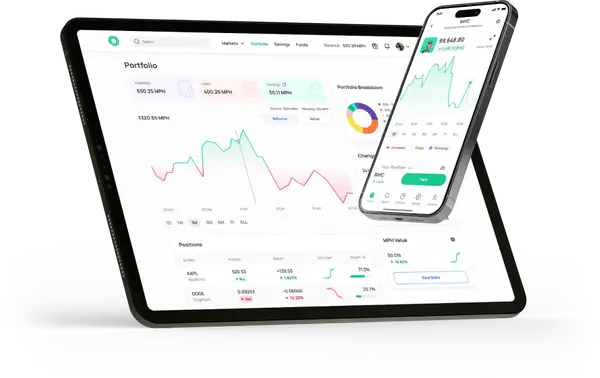

Choosing the Right Tools for ICT

The detailed nature of ICT trading strategies means that having the right platform is essential for execution. Morpher provides a seamless environment for trading various asset classes with zero fees, infinite liquidity, and access to real-time market data. Whether you’re trading commodities, stocks, or crypto, Morpher allows you to apply your ICT strategies without restrictions.

With up to 10x leverage, you can amplify your trades and take full advantage of institutional price movements while maintaining strict risk control. Plus, with Morpher’s AI-driven insights, you can stay ahead of the market and trade confidently.

Ready to elevate your trading? Sign Up Today and unlock the power of ICT strategies on Morpher.

Common Mistakes to Avoid

While implementing your ICT trading strategy, it's important to be aware of common mistakes that traders often make:

- Chasing trades or entering positions based on impulsive decisions rather than following a structured approach.

- Overtrading, which can lead to excessive risk exposure and poor decision-making.

- Ignoring risk management principles and failing to set appropriate stop-loss levels.

- Being overly influenced by short-term market fluctuations and losing sight of the bigger picture.

FAQs

What is ICT trading?

ICT trading, or Inner Circle Trader trading, is a trading approach developed by Michael Huddleston that focuses on market structure and the psychology of institutional traders. It aims to give individual retail traders an edge by understanding how market manipulations occur.

Why is having a trading strategy important?

A trading strategy provides structure and guidance for making informed trading decisions. It helps eliminate emotional decision-making and improve consistency in executing trades, ultimately enhancing performance and mitigating risks.

How can I develop my own ICT trading strategy?

To develop your own ICT trading strategy, start by identifying your trading goals. Then, explore and experiment with various ICT trading tools that align with your objectives. Once you have a clear plan, implement it step by step and adapt as needed based on your experience and performance.

What are common mistakes to avoid in ICT trading?

Common mistakes to avoid in ICT trading include making impulsive trading decisions, overtrading, ignoring risk management principles, and being overly influenced by short-term market fluctuations. Staying disciplined and following a structured approach can help mitigate these risks.

Now armed with the knowledge of ICT trading strategies and principles, you are well on your way to becoming a more informed and successful trader. Remember, consistent learning, practice, and adaptability are key elements to thrive in the dynamic world of trading. Best of luck on your trading journey!

Ready to put your newfound ICT trading knowledge into practice? Look no further than Morpher, the revolutionary trading platform that's changing the game with zero fees, infinite liquidity, and the power of blockchain technology. Whether you're interested in stocks, cryptocurrencies, or even niche markets like NFTs, Morpher offers a unique and flexible trading experience. Embrace the future of investing with fractional shares, short selling without interest fees, and up to 10x leverage to amplify your trades. Plus, with the Morpher Wallet, you have complete control over your funds. Sign Up and Get Your Free Sign Up Bonus today to start trading on a platform as innovative as your strategies!

Disclaimer: All investments involve risk, and the past performance of a security, industry, sector, market, financial product, trading strategy, or individual’s trading does not guarantee future results or returns. Investors are fully responsible for any investment decisions they make. Such decisions should be based solely on an evaluation of their financial circumstances, investment objectives, risk tolerance, and liquidity needs. This post does not constitute investment advice.

Painless trading for everyone

Hundreds of markets all in one place - Apple, Bitcoin, Gold, Watches, NFTs, Sneakers and so much more.

Painless trading for everyone

Hundreds of markets all in one place - Apple, Bitcoin, Gold, Watches, NFTs, Sneakers and so much more.