“Insufficient Liquidity for This Trade” Solved ✅

Liquidity is a crucial factor in any financial market, and it is especially important for traders who need to buy and sell assets quickly. When there is insufficient liquidity in the market, it can lead to a number of problems, including wider bid-ask spreads, increased volatility, and the inability to execute trades at desired prices.

In this guide, we will discuss what is liquidity, the causes of insufficient liquidity in the market and what can you do to solve this problem.

Understanding Liquidity

In financial markets, liquidity refers to the level of ease with which a trader can buy or sell an asset. A market is considered liquid if it has a large number of market participants and if there is a high volume of trades being executed.

Liquidity is an important factor for traders because it allows them to execute trades quickly and at a fair price, which is essential for successful trading. Additionally, a highly liquid market is less susceptible to large price swings or crypto market cycles overall, making it less risky for traders.

In contrast, low liquidity in a market means that there are limited buyers and sellers, and as a result, it may be difficult for traders to execute trades at the prices they desire.

Here’s an example of how liquidity works in trading:

Imagine you want to buy 10 shares of ABC Inc. at $50. You go to your trading platform and check the ask and bid prices for ABC Inc. Let's assume the current ask price is $50.10 and the bid price is $49.90. This means that if you place a buy order at $50, it will be filled at the best available price, which is the ask price of $50.10.

The difference between the bid and ask prices is $0.20 and is referred to as the spread. A narrow bid/ask spread such as this indicates that ABC is heavily traded, and is considered a highly liquid market.

Now, let's consider another scenario where you want to buy 10 shares of XYZ Inc. at $50. You go to your trading platform and check the ask and bid prices for XYZ Inc. Let's say the current ask price is $53.50 and the bid price is $48.00. This means that if you place a buy order at $50, it will not be filled at $50, but rather at the best available price, which is the ask price of $53.50. The spread in this case is much wider, at $5.50.

Liquidity plays a crucial role in trading. No matter if you are trading forex, stocks, or any other market. That is also why, many institutional investors use dark pool trading. When a market is liquid, there are plenty of buyers and sellers, making it easy to trade assets at desired prices with low spreads. But when a market is illiquid, there are fewer buyers and sellers, making it difficult to trade assets at desired prices with wider spreads. This especially increases for weekend trading.

How to Fix “Insufficient Liquidity for This Trade”

Below are three ways that you can use to solve the problem of insufficient liquidity regardless of which trading platform you use:

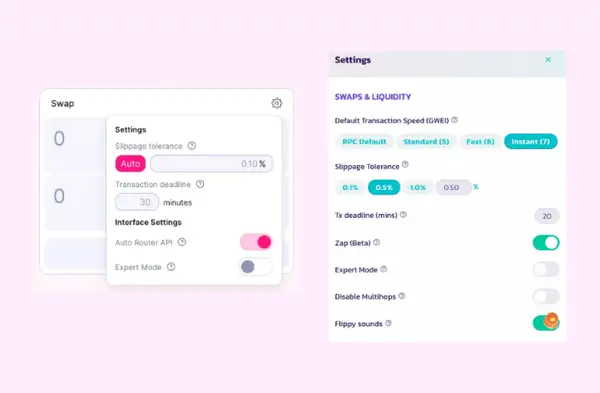

Method #1: Increase Slippage Tolerance

One way to fix insufficient liquidity is to increase your slippage tolerance. Slippage refers to the difference between the expected price of a trade and the actual price at which the trade is executed. By increasing the slippage tolerance, you may be able to execute trades even when there is not enough liquidity in the market.

On Uniswap and Pancakeswap for example, traders can adjust the slippage settings in the trade interface.

However, increasing slippage tolerance comes with a major drawback. In most cases, you will end up paying a much higher price than you intended, which can lead to reduced returns or even losses depending on which trading strategy you are using.

Method #2: Reduce Purchase Amount

Reducing the purchase amount is probably the simplest method to deal with insufficient liquidity. By decreasing the order size, you can reduce the impact on the market and increase the likelihood of the order being filled at the price you want.

The only disadvantage to this option is that reducing the purchase amount also means that you will compromise on your potential gains. If you want to avoid slippage and get a good price, then this trade-off can be worth it.

Method #3: Use Morpher’s Infinite Liquidity

If you want to trade freely without any insufficient liquidity errors, consider trading on Morpher. Morpher is a next-generation trading platform that offers infinite liquidity regardless of the asset you want to trade.

The Morpher trading platform operates on the Ethereum blockchain and uses smart contracts to facilitate trades, eliminating the need for intermediaries. Instead of relying on a counterparty to buy or sell assets, transactions are carried out directly through a smart contract protocol.

The Morpher protocol records all the trades on the blockchain, and automatically mints or burns MPH tokens based on the changes in value of the underlying market. For example, if a trader places a bet of 1000 MPH tokens on Bitcoin (BTC) and the value of BTC rises by 20%, the trader will receive 1200 MPH tokens. If the value drops by 20%, the trader will receive 800 MPH tokens.

When trading on Morpher, traders do not actually own the underlying asset. They are betting on a virtual copy of the real asset. This tokenized system provides Morpher with the ability to eliminate intermediaries and provide instant order execution. There are no finite order books, no slippage, and hence, no liquidity constraints. In essence, traders on Morpher enjoy the advantage of trading with infinite liquidity, which is unparalleled in traditional trading platforms.

How to Measure Liquidity in the Crypto Market

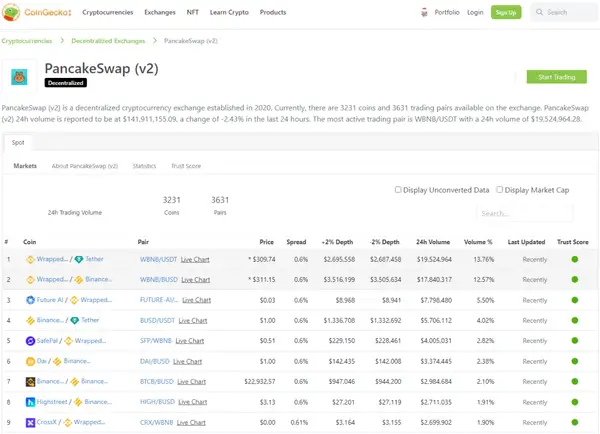

Websites like CoinGecko provide information on liquidity for each pair on different exchanges. In the example below you can see the liquidity of PancakeSwap’s assets.

The +2% and -2% depth figures are used to determine the liquidity of a particular market. A higher figure indicates that there is more liquidity in the market, while a lower figure indicates that there is less liquidity.

As a rule of thumb, to have enough liquidity, you want to see at least a few tens of thousands on the +2% or -2% depth columns.

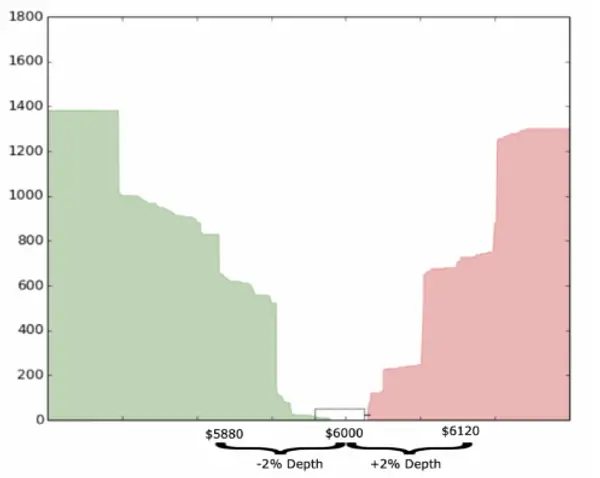

To calculate the +2% depth, Coingecko takes the last done price for a particular market and then calculates the 2% upper bound. For example, if the BTC/USDT market on a particular exchange was last traded at $6,000, the 2% upper bound would be $6,120. Then they sum up the amount of BTC sitting in the orderbook between $6,000 and $6,120 and multiply it by the order price. This resulting figure is the amount of capital required to move the orderbook up by 2%.

The calculation of the -2% depth follows the same principle. Using the same example, if the BTC/USDT market was last traded at $6,000, the 2% lower bound would be $5,880. To find the amount of capital required to move the orderbook down by 2%, Coingecko adds up the amount of BTC in the orderbook between $5,880 and $6,000, and multiplies the sum by the order price.

Conclusion

Without sufficient liquidity, the chances of finding counterparties willing to take part in the trade are slim. There are various ways to solve this issue, including increasing slippage tolerance, reducing the purchase amount, or selecting a platform that offers infinite liquidity like Morpher.

Disclaimer: All investments involve risk, and the past performance of a security, industry, sector, market, financial product, trading strategy, or individual’s trading does not guarantee future results or returns. Investors are fully responsible for any investment decisions they make. Such decisions should be based solely on an evaluation of their financial circumstances, investment objectives, risk tolerance, and liquidity needs. This post does not constitute investment advice.

Painless trading for everyone

Hundreds of markets all in one place - Apple, Bitcoin, Gold, Watches, NFTs, Sneakers and so much more.

Painless trading for everyone

Hundreds of markets all in one place - Apple, Bitcoin, Gold, Watches, NFTs, Sneakers and so much more.