Article Contents

Thanks a Million

We recently passed over one million trades on Morpher! What a milestone, it feels like yesterday we decided to start this crazy journey back in April 2018. I want to take this chance to zoom out: celebrate our progress a bit while sharing what I'm excited for in the future.

Celebrating 1 million trades 🎉

Can you guess what the millionth trade was? It was 122 MPH spent on buying Gold ($XAU) with a leverage of 7. I think this trade exemplifies what we built Morpher for. Taking a big bet (7x leverage!) with just $3.

The first trade, back in June 2020 was buying Cardano. Since then over 400,000 traders from 180 countries used Morpher. They traded 690 different markets. Nearly 60% of traders used leverage, effectively trading 2 trillion MPH in the process. Meanwhile 20% traded when the underlying markets were closed – like on a weekend or night owls during the week 🌚.

Morpher is a place contrarian investors can thrive, with 55% of traders shorting markets like $AAPL, $TSLA, and $XRP. These contrarians leveraged 70 million MPH to short Bitcoin and 13 million MPH to short Sherwin-Williams (who knew paint was a controversial business).

Nonetheless, my favorite statistic is the following: we gave away $1.5 million USD over the last year (in MPH). The reason this stat is my favorite is that it means we've enabled thousands, that wouldn't have otherwise, to start their investment journeys completely risk-free. For users around the world to achieve financial success, we have to first solve market access.

GameStop saga

If you did not follow this story, there's a great writeup by Yun Li about the original events. There's even recent developments with class action lawsuits and retail investors tackling Citadel. The 10 second synopsis: too many people traded $GME on Robinhood, Robinhood had a liquidity problem, that turned into a capital crunch, so they disabled stock and options trading to survive. Then they raised billions to enable trading again.

Meanwhile, we saw all of this unfold and realized we didn't have GameStop on our platform yet. So we added GameStop, Blackberry, AMC, Tootsie Roll, and Bed, Bath & Beyond in one day. No need to raise a single cent and each market was perfectly liquid. The best part was seeing what happened next. Traders from 130 different countries got in on the action: 20% traded on nights & weekends (when markets stopped but news did not), 20% decided to short these stocks, and 50% used leverage to power up their trades.

On many levels this whole saga was a reaffirmation of our mission. The importance of truly democratizing investing, getting more markets into the hands of everyone around the world.

Quiet wins 🤫

I'm incredibly proud of our dev team, but you rarely get to see their efforts. Not every backend improvement or systems upgrade is flashy. And we don't filter it through a crack marketing team. There's a bittersweet hilarity from users tweeting at us “what have you been doing?” while the devs are doing incredible work behind the scenes. So here are a couple highlights to celebrate their hard work.

Smooth & steady layer 2

Our sidechain is approaching 4 million transactions. There have been numerous upgrades behind the scenes to ensure smooth and fast transactions. Without a great layer 2 solution, we could have never reached one million trades. The sidechain avoids gas fees while processing each transaction in about a second. Every airdrop, trade, deposit and withdrawal has relied on the it. With nearly zero downtime and a full sync with mainnet Ethereum, our sidechain and its maintainers are unsung heroes.

Data, data, data

Turns out data providers drop the ball all the time, and it's our responsibility to make sure their screw-ups don't pass on to our users. Offering free, high-quality market data is a pain in the butt! Making sure weird prices are ignored and that data is never down is a constant struggle.

There have been some serious upgrades to our data processing too. We added full redundancy across most markets. We aggregated multiple feeds with differing prices into one seamless price. And of course added more markets, more of the stocks and cryptos that you love.

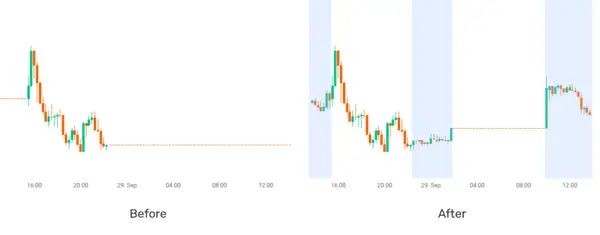

Earlier this year we added extended hours data for stocks. This was a big achievement on multiple levels, from technical to operational (like affordable display rights). The end result is dramatically better spreads and more accurate stock charts.

Our data processing has been improving on an almost weekly basis. At this point, I'm confident we have the best market oracle around. Nothing comes close in speed, quality, or gas fees (on mainnet). More on that in our roadmap.

Product wins

I work on product, so how could I not highlight some of my favorite product roll outs.

Stop Loss and Take Profit

SL/TP is a critical trading feature, yet it's hard to build on top of blockchain-based trading. Since launching SL/TP we've had 19% of trades closed this way. Majority of these were in the middle of the night when users are offline. Giving traders peace of mind as they dream of gains 😴.

Crypto deposits

For the crypto natives we unlocked a new deposit method. Last month a third of deposit volume was in ETH, BTC, and LTC instead of USD. Depending on the region, sending crypto is far simpler than using a payment on-ramp. A great early step, but deposits and withdrawals both need to dramatically improve before Morpher can serve more users.

Wallet

The crypto wallet is the gateway for any DApp, and the first interaction a user ever makes. Yet existing solutions were leaving our users deeply confused and frustrated. Thomas, our CTO, has a great article on those frustrations. At the end of the day, it was just too hard to sit back and rely on a 3rd party for something as critical as login and managing funds.

Morpher Wallet was released early September with 21,000 happy users so far. Follow-on trades were up 85% in large part thanks to the seamless new wallet experience ✨. I've done a deep dive article on all the great features, but let's name a few here:

- Non-custodial, you own the keys

- Trusted recovery (backup to Google/FB/VK)

- 2-Step verification for max security

- Export anytime and change wallets

Oh and it's open-source, we're proud to share it with the community to learn, build, and improve.

DEX

One year after we opened our trading app to the public, we released the decentralized version: Morpher DEX. Danilo created a short and sweet introduction article, Thomas put out a how-to video for beginners, and Brooke has a great introductory video for everyone.

Decentralization is the future for most industries, but hands down the clear future for finance. However, we're not there yet. Morpher DEX is great for the audience that wants total, permissionless control over their investments. Being able to short Tesla stock with a few clicks, from any crypto wallet, is just mind-blowing and awesome. Too bad Ethereum fees are so dang high recently.

The future

The future is bright, or at least full of things I'm really excited to work on. Like sidechain staking, a super high yield savings account built right into Morpher. Or our first trading competition, pitting investors from around the world in a battle for maximum gains. Real limit orders are coming too, so you can enter a market at the perfect moment without being at your keyboard.

Deposits & withdrawals

Funding your account needs to be a simple and easy process, which at the moment it just isn't. For most users it still doesn't work. Finding the right banking partners takes time and we've been working on this for months. The good news is we're making progress! We'll slowly be rolling out options for deposits/withdrawals that work well in different regions around the world.

Mobile app

It turns out many people prefer to monitor and manage their financial lives from their smartphone. With DEX and Wallet out, we're shifting focus to building a great native mobile experience. Speaking of wallet, it's what will enable a truly native experience across iOS and Android. Expect to try the mobile beta towards the end of the year.

Decentralized oracle

Our market data is superb, so why not release something like Chainlink but that's actually decentralized and designed for active on-chain trading. This will also be the first time MPH finds a new use case. MPH will be used for governing the oracle, selecting data providers, and rewarding data contributors.

Take a look at our roadmap for the full list of what's coming next, and come tell us on Discord if you want to see something else.

So that's it, one million trades. On to bigger milestones and better user experiences and amazing new features. Investing is still only accessible to a small minority around the world. A problem that can't be solved without a radically new approach to markets. I'm more confident than ever that Morpher's virtualization technology will be that bridge for the rest of the world.

Disclaimer: All investments involve risk, and the past performance of a security, industry, sector, market, financial product, trading strategy, or individual’s trading does not guarantee future results or returns. Investors are fully responsible for any investment decisions they make. Such decisions should be based solely on an evaluation of their financial circumstances, investment objectives, risk tolerance, and liquidity needs. This post does not constitute investment advice.

Painless trading for everyone

Hundreds of markets all in one place - Apple, Bitcoin, Gold, Watches, NFTs, Sneakers and so much more.

Painless trading for everyone

Hundreds of markets all in one place - Apple, Bitcoin, Gold, Watches, NFTs, Sneakers and so much more.