The Crypto Bubble Burst: What You Need to Know

The cryptocurrency market is signalling the possibility of pushing new highs this year, with Bitcoin hitting $50,000 for the first time since 2021 and reaching to a new All-Time-High. However, the inability of even the leading cryptocurrency to hold on to these levels has many experts and investors wondering whether we are in the midst of a crypto bubble that is destined to burst. Some argue that cryptocurrencies are here to stay and will continue to appreciate, while others believe the market is overheating and a crash is imminent. In this article, we will answer the question of what a crypto bubble is, examine some indicators that signal whether a bubble exists at all, and discuss possible exit strategies for concerned investors.

What is a Crypto Bubble?

A crypto bubble occurs when cryptocurrency prices surge beyond their true value, fueled by hype and FOMO, often ending in rapid and sharp corrections.

A sudden influx of new investors, driven primarily by the worry of missing out on potential profits, floods the market during a crypto bubble. This increased demand causes prices to soar, often far beyond what the underlying technology or asset is actually worth. As the bubble continues to inflate, more and more investors join in, fuelling the frenzy and creating a self-perpetuating cycle. However, it is important for investors to be cautious as these bubbles eventually burst, leading to a sharp decline in prices and significant losses for those who bought in at the peak. Therefore, understanding the indicators of a crypto bubble and having exit strategies in place can help investors protect their investments.

The History of Crypto Bubbles

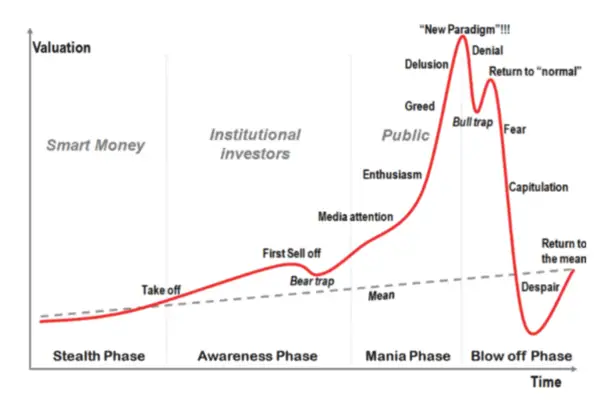

The history of crypto bubbles is an interesting one. Since the inception of Bitcoin in 2009, we have witnessed several boom and bust cycles. Market speculation, technological advancements, and regulatory influences are frequently the driving forces behind these cycles.

The first appearance of the crypto bubble actually dates back to the early days of Bitcoin, the first and most well-known cryptocurrency. Bitcoin experienced its first major bubble in 2011, when its price skyrocketed from a few cents to over $30 in a matter of months. This spike in value caught the attention of both investors and the media, leading to a frenzy of buying and speculation. However, the bubble eventually burst, and the price of Bitcoin plummeted to single digits, leaving many early investors with significant losses. This pattern of boom and bust has been repeated several times in cryptocurrency history, with each bubble becoming more pronounced and attracting even more attention.

The infamous Bitcoin bubble of 2017 is the one that taught many investors the term crypto bubble; the price soared to almost $20,000 and then crashed to around $3,000 just a year later. This unprecedented price volatility shocked the financial world and left many investors confused about the future stability and adaptability of cryptocurrencies.

The most recent example of a crypto bubble was in 2021, when the price of Bitcoin reached an all-time high of over $60,000 before experiencing a significant correction. These bubbles and corrections serve as important reminders that the crypto market is still in its early stages of development and lacks the stability of traditional financial markets. However, they also highlight the potential for significant gains for those who can navigate the market successfully. As the industry continues to mature, it is crucial for investors to stay informed and exercise caution when entering this highly unpredictable market.

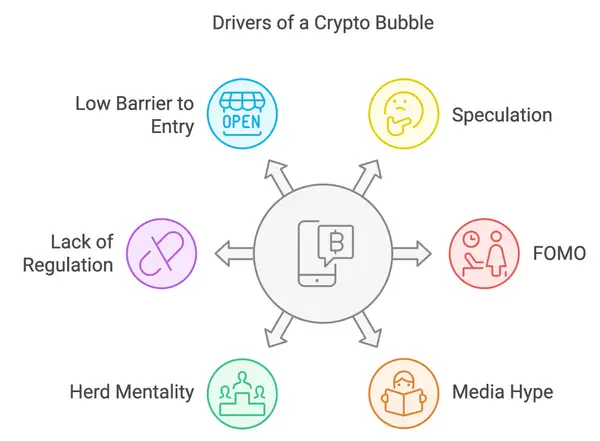

The Drivers of a Crypto Bubble

Now that we have a good understanding of what a crypto bubble is, let's explore its dynamics and how different elements come into play.

Speculation: Speculative behavior plays a significant role in inflating crypto bubbles. Many investors buy into cryptocurrencies not because of their intrinsic value or utility, but with the hope of selling them later at a higher price to make a profit.

FOMO (Fear of Missing Out): FOMO often drives investors to jump into the market out of fear of missing out on potential gains. Cryptocurrencies, especially those with a limited supply, can be seen as a scarce asset that has the potential to increase in value over time. This scarcity mentality often leads to a fear of missing out (FOMO) among investors, causing them to buy into the market at inflated prices.

Media Hype: Positive media coverage and hype surrounding cryptocurrencies can contribute to a bubble. News stories about overnight millionaires and extraordinary returns can fuel investor enthusiasm and draw more people into the market.

Herd Mentality: When prices are rising rapidly, investors may follow the crowd without conducting their own research or analysis. This herd mentality can amplify market movements and contribute to the formation of bubbles.

Lack of Regulation: Without clear guidelines and safeguards in place, fraudulent activities and market manipulation can thrive, leading to increased volatility and unsustainable price increases. On the other hand, sudden regulatory interventions or crackdowns on cryptocurrencies could burst the bubble as investors scramble to exit the market. This is a case in point, with many investors holding their breath for the SEC's ETF decision.

Low Barrier to Entry: The ease of access to cryptocurrencies through online platforms and exchanges lowers the barrier to entry for new investors. This accessibility can lead to a flood of inexperienced investors entering the market, further driving up prices. On the other hand, with so many options, it can be overwhelming to choose a reliable platform that will be there for you every step of the way as you navigate your financial path.

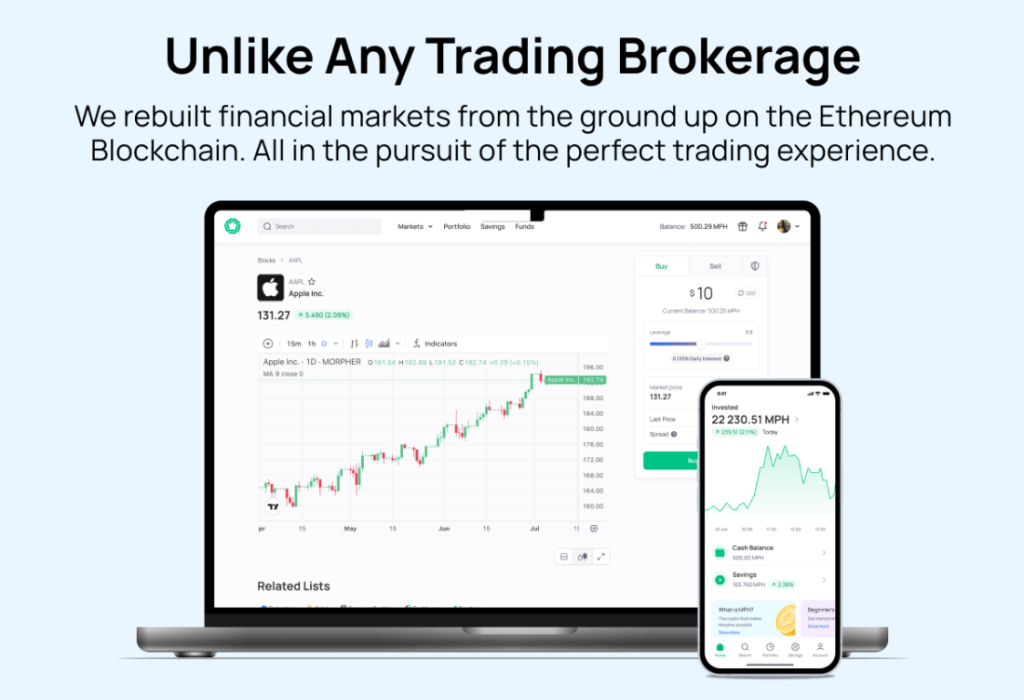

That's where Morpher comes in. Morpher is not just another crypto platform. Morpher is a financial assistant that will be there for you every step of the way on your financial journey, helping you overcome any barriers that may arise. With our revolutionary platform, you can navigate the crypto world with zero fees, infinite liquidity, and partial trading flexibility. If the idea of a crypto bubble is too risky for you, Morpher offers 700 digital assets to choose from, including commodities, stocks, indices, and more.

Whether you're looking to capitalize on market trends or protect your investments with short selling, Morpher provides the tools you need for a unique and empowered trading experience. Sign Up and Get Your Free Sign Up Bonus today to join a community of trading moguls.

Warning Signs for a Crypto Bubble

Financial indicators serve to convey many messages about investor behavior and overall market sentiment. Therefore, as the crypto market is constantly evolving, it's important to be alert to what certain financial indicators are trying to tell us in case of potential bubble signs. Here are some key financial indicators that could signal that you are in a crypto bubble that is ready to burst:

-

Rapid Price Increases: Sudden and significant price surges across multiple cryptocurrencies without clear fundamentals to support such movements.

-

Volatility: extreme price fluctuations within short timeframes, indicating speculative trading rather than stable investment patterns.

-

High Trading Volume: increased trading activity accompanied by large buy or sell orders, potentially driven by emotional trading rather than rational analysis.

-

Market Capitalization: Exponential growth in the total market capitalization of cryptocurrencies surpasses realistic valuations based on adoption and utility.

-

Fear and Greed Index: Extreme readings on sentiment indicators like the Fear and Greed Index suggest irrational exuberance or panic in the market.

-

Increased Margin Trading: Rising levels of margin trading and leverage within cryptocurrency markets are amplifying both gains and losses.

Preparing for the Burst of the Crypto Bubble

As the cryptocurrency market experiences increased volatility and uncertainty, it is critical to have a well-planned exit strategy in place to protect your investments. Here are some important considerations for preparing for the potential burst of the crypto bubble:

Diversify Your Portfolio

Spread your investments across different asset classes, including traditional stocks, bonds, and commodities, to reduce your exposure to the crypto market. Diversification can help mitigate losses in the event of a market downturn.

Monitor Market Sentiment

Keep a close eye on sentiment indicators, such as the Fear and Greed Index, to gauge investor sentiment and market psychology. Extreme readings may signal a market bubble or impending correction, prompting you to consider adjusting your exit strategy accordingly.

Implement Stop-Loss Orders

Consider using stop-loss orders to automatically sell your crypto assets if prices fall below a certain predetermined level. Stop-loss orders can help limit potential losses and protect your capital during periods of market volatility.

Stay Disciplined

Stick to your predefined exit strategy and avoid making impulsive decisions based on emotions or short-term market fluctuations. Maintain discipline and focus on your long-term investment objectives.

Prepare for Market Crashes

Be mentally prepared for the possibility of a market crash and its potential impact on your investments. Having a plan in place can help alleviate stress and uncertainty during turbulent market conditions.

FAQ – Frequently Asked Questions

What is a crypto bubble?

A crypto bubble refers to a speculative frenzy in the cryptocurrency market where prices of digital assets skyrocket due to excessive optimism and hype. This is followed by a burst, leading to significant price corrections.

What drives the crypto bubble?

The crypto bubble is propelled by a combination of speculation, fueled by the Fear of Missing Out (FOMO), media hype, and herd mentality, as investors chase potential profits without thorough research. Lack of regulation creates an environment ripe for fraudulent activities, while the low barrier to entry attracts inexperienced investors, further driving up prices.

How can I prepare for the burst of the crypto bubble?

To prepare for the bursting of the crypto bubble, start by ensuring that you are not one of the factors that caused it in the first place. Preparing yourself as an investor capable of making sound financial decisions, rather than being driven by speculation and FOMO, will allow you to test the hype's validity. For example, correctly reading crypto charts and recognizing the patterns that indicate price movement will assist you in making the right move at the right time.

What is the future of cryptocurrencies post-bubble?

Despite the ups and downs of the market, cryptocurrencies are poised to have a significant impact on the global economy due to recent developments. With the increasing presence of cryptocurrencies in the portfolios of institutional funds and investment firms, there is a sense of optimism for the future of crypto. Projected trends encompass market maturation, regulatory measures, the emergence of stablecoins and CBDCs, and the incorporation of blockchain technology into conventional financial systems.

Is a crypto bubble happening now?

The cryptocurrency market is highly volatile and uncertain, making it difficult to predict whether a bubble is forming or if a bitcoin crash is imminent. Several ongoing concerns, such as cryptocurrency exchanges experiencing financial difficulties, regulatory crackdowns in various countries, environmental concerns, security vulnerabilities, and the market's reliance on speculation, add to the uncertainty. Recent actions by regulators, such as the Financial Conduct Authority (FCA) in the United Kingdom, indicate an increased emphasis on mitigating the risks associated with cryptocurrencies. While increased regulation may cause short-term volatility and investor concern, it may also promote a more stable and secure market in the long run. As market conditions and regulatory measures continue to change, it is unclear whether a crypto bubble is currently underway or if a bitcoin crash is on the horizon.

As time-consuming as it may appear, there is a very simple way to keep up with the dynamics of the cryptocurrency market, which is influenced by a variety of factors. Morpher AI has been launched to make your financial journey as smooth as possible. It is integrated directly into the platform and ensures that AI-powered market predictions gathered from various news sources are always available. These AI-powered market insights, which are free for all Morpher users, as well as detailed TradingView-powered price charts for practice, will keep you up to date on the market's movements at all times. If you want to make your financial journey as comfortable as possible, Sign Up and Receive Your Free Sign-Up Bonus.

Disclaimer: All investments involve risk, and the past performance of a security, industry, sector, market, financial product, trading strategy, or individual’s trading does not guarantee future results or returns. Investors are fully responsible for any investment decisions they make. Such decisions should be based solely on an evaluation of their financial circumstances, investment objectives, risk tolerance, and liquidity needs. This post does not constitute investment advice.

Painless trading for everyone

Hundreds of markets all in one place - Apple, Bitcoin, Gold, Watches, NFTs, Sneakers and so much more.

Painless trading for everyone

Hundreds of markets all in one place - Apple, Bitcoin, Gold, Watches, NFTs, Sneakers and so much more.