What Is KYC in Crypto and Why Does It Matter?

KYC, or Know Your Customer, is a key regulation in the fight against money laundering and financial fraud. As the financial industry evolves, including the rapidly growing cryptocurrency market, KYC is becoming increasingly important for financial institutions and service providers to implement in order to protect customers and assets. While some may see KYC as conflicting with the principles of anonymity and decentralization in the cryptocurrency market, it is becoming increasingly necessary as the market matures and attracts mainstream investors.

In this article, we will explain what KYC is and why it is important to implement robust procedures in the financial industry. Moreover, we will discuss the role of KYC in the cryptocurrency market.

- Why Do Crypto Platforms Require KYC?

- The KYC Process

- Trading Crypto without KYC Check? A Big Risk!

Why Do Crypto Platforms Require KYC?

Legal And Regulatory Requirements

KYC regulations vary by country but often involve similar information requirements. The EU, Asia-Pacific countries, and the US have their own regulations, but there's a lot of overlap. The EU Anti-Money Laundering Directive (AMLD) and PSD2 regulations provide the main framework for EU countries, which Morpher follows. At a global level, the Financial Action Task Force (FATF) coordinates multinational cooperation on regulatory conditions.

Measures and requirements include customer due diligence, record-keeping, and reporting suspicious transactions to the relevant authorities. The AMLD also establishes a system for the exchange of information between EU member states and the European Commission to ensure effective cross-border cooperation in the fight against money laundering and terrorist financing. For a more comprehensive overview of crypto regulations around the world, you might want to read the global guide of Comply Advantage.

Protecting Against Money Laundering And Fraud

KYC checks are becoming increasingly important in the cryptocurrency industry as it helps to combat illegal activities such as money laundering, tax evasion, facilitating sanctions evasion, or terrorist financing. Blockchain transactions are irreversible and the anonymous nature of cryptocurrency makes it vulnerable to fraud.

KYC checks help to ensure the safety of funds and increase the regulation of the industry. While it may take longer to set up an account, it is a necessary step for the security and integrity of the market.

Enhancing Customer Trust and Confidence

KYC (Know Your Customer) regulations help to enhance customer trust and confidence by providing a measure of security and protection. By verifying the identity of customers and monitoring for suspicious activity, financial service providers are able to ensure that customers' assets and personal information are protected. As Morpher is also falling into the category of financial service providers, we are also required to comply with regulations. Hence, we attempt to have easy, yet robust KYC procedures for our customers.

As Brian Armstrong, the CEO of Coinbase wrote in a recent article on “Crypto Regulations: How We Move Forward as an Industry from Here,” it is an open secret that there are a handful of questionable actors not following the correct rules, resulting in unpleasant experiences for customers:

“FTX.com was a good example of this, being based out of the Bahamas while serving customers in many countries, including some U.S. citizens, due to weak KYC controls. In my opinion, FTX.US entity was partially real, but also partially a facade to distract U.S. regulators from their primary business.”

The KYC Process

Gathering And Verifying Personal Information

The KYC process is about verifying the identity of customers. Thus, it often involves uploading some information about yourself like a driver's license. Once this information is collected, it must then be verified to ensure its accuracy and authenticity. This can be done through various means such as comparing the information provided with government databases or other trusted sources, and using biometric identification methods like facial recognition.

While gathering and verifying personal information can be a time-consuming and complex process, it is a critical step in ensuring the security and integrity of the cryptocurrency market. For that reason, Morpher has the most up-to-date software for identification methods. An independent third-party provider like ID Analyzer can make the KYC process more automated and seamless. Furthermore, a dedicated support team at Morpher helps customers, if they run into an issue during the automatic process.

Steps Involved In The KYC Process

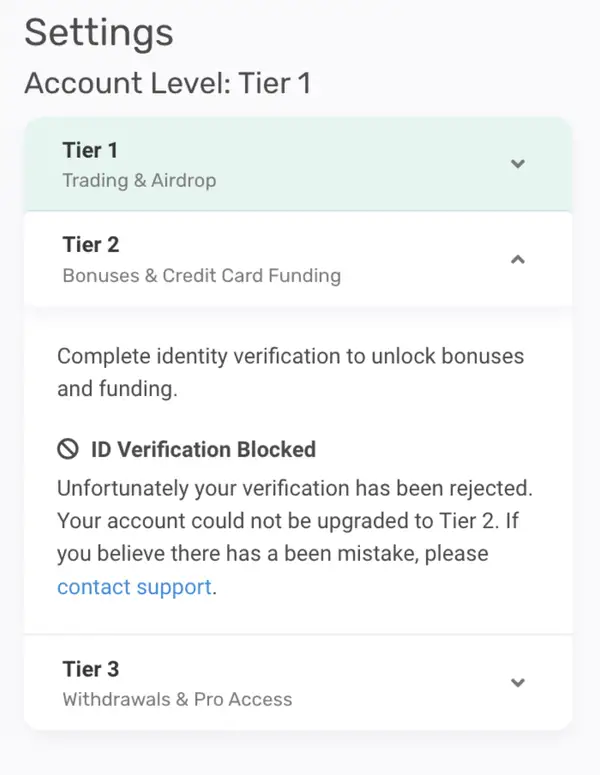

On Morpher, you are able to create an account before concluding the KYC process. However, a non-verified account presents only limited functionalities.

Morpher conducts KYC checks on all users before granting access to deposit funds on the platform. This check aims to prevent scammers and malicious actors from malicious activities on the platform.

On Morpher, you have 3 different Tiers. Tiers are user account levels. The higher your tier, the more access you have to features on Morpher. You officially have a Tier 1 level account if you have signed up on Morpher. This is the most basic level. To become a Tier 2 member, users must submit a government-issued ID. Tier 2 users are eligible to deposit and receive rewards.

Users are prompted to complete the verification process on the settings page under Tier 2 level description. To start the KYC process:

- Click on Settings

- Click “Tier 2”

- Verify your profile

Most users are verified automatically within 15 minutes of finishing the registration process. However, sometimes there might be issues like:

- Your selfie doesn't match the photo on your ID.

- The photo of your document is not clearly readable.

- Our system has detected that the document is fake or altered maliciously.

In these cases, the automatic verification process fails and you are not upgraded to Tier 2. You are able to resubmit your documents one more time after that. In case it fails twice, you require manual support.

To contact support, you can simply write an email to: contact@help.morpher.com with the problem you encountered. Manual verification can take up to 10 days, although most identities are verified within 3 days.

Finally, once you completed the verification process and also deposited $10 you become a Tier 3 user and unlock all functionalities.

Common Documents Required For KYC

All you need for Morphers KYC verification is a government-issued ID with:

- full name

- document number

- date of birth

- expiration date

However, users should not provide sensitive identifying information without first assuring that the company implements the necessary security standards to keep the data safe. Remember, safety of your personal data is one of our top priorities. Morpher is compliant with EU GDPR regulations, some of the strictest personal data protection regulations in the world. If you would like to learn more about how your data is used, check out our privacy policy.

Trading Crypto Without KYC Check? A Big Risk!

Arguments Against KYC

KYC has its benefits, but it's still a controversial topic among critics, particularly in the cryptocurrency industry. Common criticisms include issues with privacy, cost, and accessibility. Some individuals may not have the necessary documentation, making it difficult for them to access financial services. The world bank reported in 2017, that around 1.1 billion people are without IDs, meaning they would not be able to pass a KYC check. Additionally, there are concerns about data security and hacks, and some argue that it goes against the decentralized nature of cryptocurrencies.

For example, Eric Hughes, argued in his “Cypherpunk Manifesto” from 1993, that in order to maintain privacy, transactions should be anonymous, and that cash has historically been the primary example of such a system. Also, Satoshi Nakamoto wrote in the Bitcoin whitepaper:

“Merchants must be wary of their customers, hassling them for more information than they would otherwise need. A certain percentage of fraud is accepted as unavoidable. These costs and payment uncertainties can be avoided in person by using physical currency, but no mechanism exists to make payments over a communications channel without a trusted party.”

Others, like the CEO of Coinbase advocates for a mixed approach where centralized exchanges are regulated by KYC and AML, but decentralized wallets and protocols are not, as they represent a frontier for innovation that brings enormous value and protections to consumers. He also points out that KYC and AML programs have largely failed at stopping criminal activity:

“The United Nations estimates that just 0.2% of illicit funds are seized, and this study estimates that ‘compliance costs exceed recovered criminal funds more than a hundred times over’.”

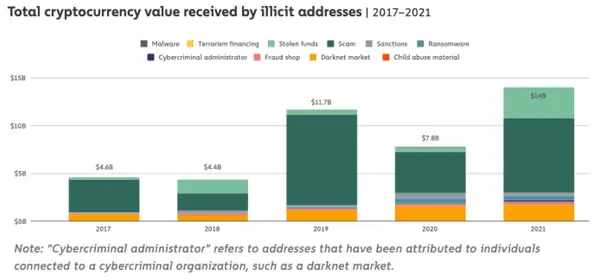

No KYC Check – A Big Risk

Despite some critics, the broad regulatory consensus is that trading cryptocurrencies without undergoing a Know Your Customer (KYC) check is a risky endeavor that could leave investors vulnerable to fraud and financial crimes. In 2021, Cryptocurrency-based crime hit a new all-time high, with illicit addresses receiving $14 billion over the course of the year, up from $7.8 billion in 2020 according to Chainalysis 2022 Crypto Crime Report. So, as long as the cryptocurrency industry matures and we do not have clear privacy-preserving solutions for fraud prevention, you should trade on platforms with robust KYC procedures. These procedures are essentially a safeguard for customers and their assets. However, even if you want to engage in a platform without KYC check, make sure you are well informed on custodial vs non-custodial wallets and the implications of “not your keys, not your coins.”

Also, the report states that exchanges without KYC are much more likely to be used by cybercriminals for illicit activities:

“…Centralized exchanges, once a top destination for stolen funds, fell out of favor in 2021, receiving less than 15% of the funds. This is likely due to the embrace of AML and KYC procedures among major exchanges—an existential threat to the anonymity of cybercriminals.”

Future Solutions For Identity Management

Nevertheless, there are multiple interesting solutions coming up on how to enhance KYC in a privacy-enhancing way. For example, the KYC process could be enhanced by using self-sovereign identity, where individuals have control over their own identity and can share only necessary information with organizations without having to update each one individually. Zero-Knowledge Proof (ZKP) technology can be used to verify identity without revealing sensitive information. This approach allows for a more efficient and secure KYC process for both the individual and the organization.

Conclusion

In conclusion, as this article has shown, Know Your Customer (KYC) checks are an essential safeguard for investors in the cryptocurrency market. Without undergoing a KYC check, investors expose themselves to a significant level of risk, including the potential for illicit activities, financial crimes, and fraud. Therefore, as the market continues to mature, it's crucial for investors to use platforms that comply with KYC regulations to ensure their transactions are secure and legitimate.

PS: If you still want to know more about the latest news on KYC, you should check out the latest crypto podcasts to stay up to date.

Disclaimer: All investments involve risk, and the past performance of a security, industry, sector, market, financial product, trading strategy, or individual’s trading does not guarantee future results or returns. Investors are fully responsible for any investment decisions they make. Such decisions should be based solely on an evaluation of their financial circumstances, investment objectives, risk tolerance, and liquidity needs. This post does not constitute investment advice.

Painless trading for everyone

Hundreds of markets all in one place - Apple, Bitcoin, Gold, Watches, NFTs, Sneakers and so much more.

Painless trading for everyone

Hundreds of markets all in one place - Apple, Bitcoin, Gold, Watches, NFTs, Sneakers and so much more.