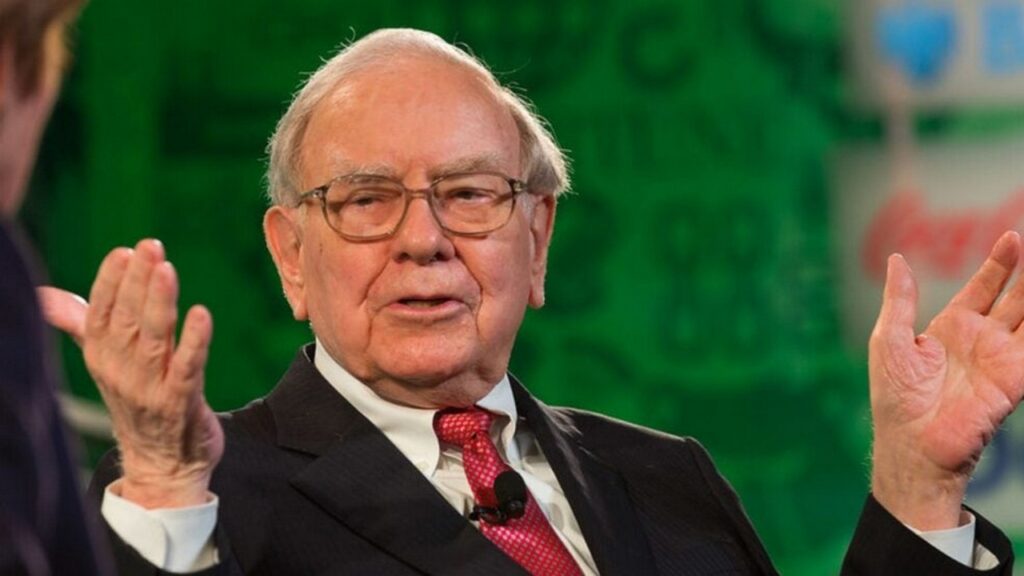

Warren Buffett Once Said That The ''Best Thing'' He Did Was Choose ''The Right Heroes'' — Who Was Berkshire Hathaway Chair''s Biggest Role Model?

Warren Buffett , the Oracle of Omaha, is known worldwide not only for his investment acumen but also for the wisdom he imparts to the business world. Among his many pieces of advice , one stands out: choosing the right heroes. What Happened: In Roger Lowenstein''s book, Buffett: The Making of An American Capitalist, Buffett spoke about the significance of his role models. "The best thing I did was to choose the right heroes," he stated, adding, "It comes from Graham." Benjamin Graham , Buffett''s mentor at Columbia University, often referred to as the father of value investing, had a huge impact on Berkshire Hathaway''s chair. Graham''s teachings were not just about making money but about living a principled and disciplined life. … Full story available on Benzinga.com

https://www.benzinga.com/news/24/08/40120575/warren-buffett-once-said-that-the-best-thing-he-did-was-choose-the-right-heroes-who-was-berkshire-ha