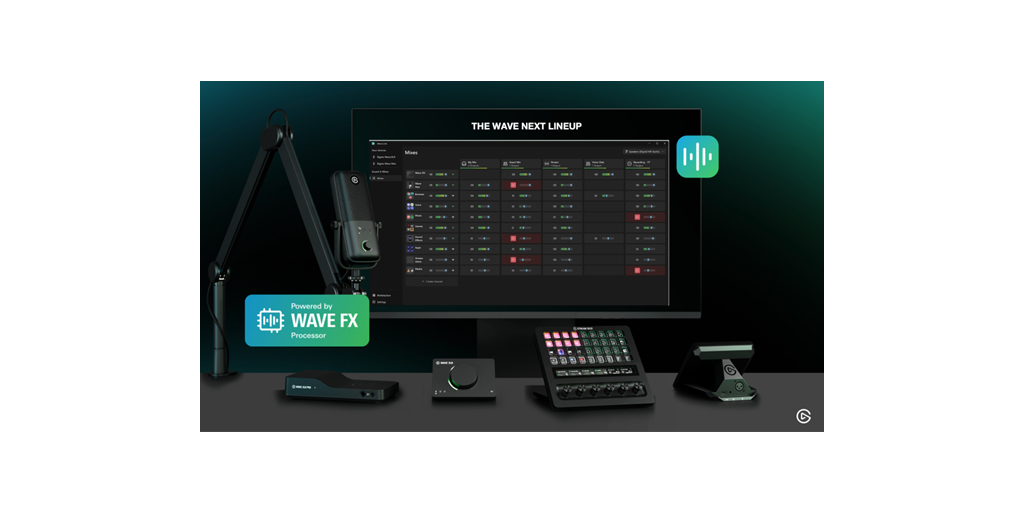

Corsair’s Elgato Unveils Wave Next: A Unified Audio Platform Designed to Power the Next Generation of Creators

This article announces Elgato's new product, Wave Next, a unified audio platform aimed at content creators. It highlights the platform's features designed to streamline audio workflow and enhance creativity.

https://www.businesswire.com/news/home/20260305495625/en/Corsairs-Elgato-Unveils-Wave-Next-A-Unified-Audio-Platform-Designed-to-Power-the-Next-Generation-of-Creators