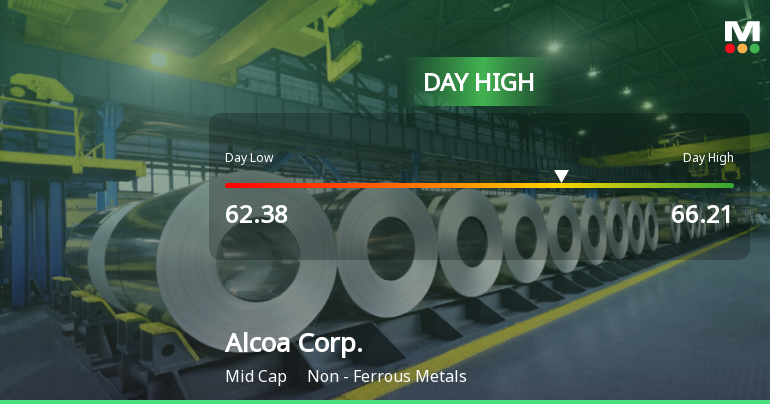

Alcoa shares slide after volatile session and apparent profit-taking near new 52-week high

Alcoa's shares (AA) dropped 3.6% after a volatile intraday session, characterized by profit-taking and repositioning near a new 52-week high. The decline is attributed to a quick "fade" in momentum rather than a sustained trend, influenced by mixed Wall Street sentiment and the stock's sensitivity to aluminum prices. Recent analyst ratings and price targets contribute to the complex outlook, with institutional investors showing varied activity.

https://www.quiverquant.com/news/Alcoa+shares+slide+after+volatile+session+and+apparent+profit-taking+near+new+52-week+high