Key Differences of Stocks, Forex, and Crypto Trading: A Comprehensive Guide

In the world of financial trading, understanding the nuances of various markets can make all the difference. While all markets—stocks, crypto, and forex—offer exciting opportunities, they each operate under different rules, dynamics, and behaviors.

In this article, we’ll break down the key factors that set stocks, crypto, and forex apart—focusing on their market structure, trading hours, volatility, and other critical elements. By the end, you'll have a clear understanding of how each market operates, allowing you to choose the one that best fits your trading goals. Here’s a detailed comparison to help traders recognize the distinct characteristics of each and decide which aligns best with their goals.

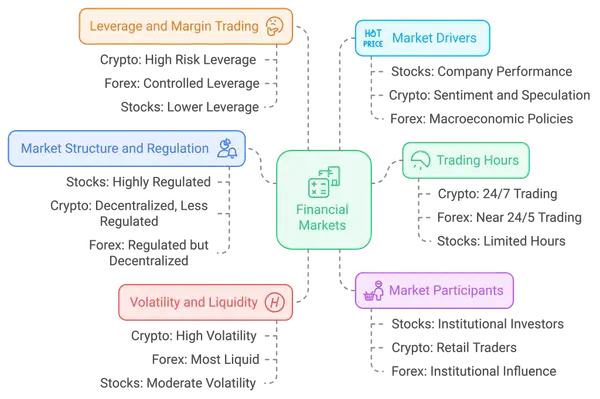

Key Differences Overview

1. Market Structure and Regulation

Stocks

The stock market is one of the most heavily regulated financial environments. Companies listed on stock exchanges must adhere to strict financial reporting standards, and investors benefit from a high level of transparency. Regulatory bodies like the SEC (U.S.), FCA (UK), and others ensure that these markets operate fairly, protecting both retail and institutional investors.

Crypto

In contrast, the cryptocurrency market operates with far less regulation. While some countries have started introducing frameworks, it remains largely decentralized, with no overarching authority governing its operations. This decentralized nature appeals to many, but it also leads to higher risk, including susceptibility to scams, market manipulation, and sudden changes in regulations.

Forex

The forex market is also heavily regulated, though the degree of regulation depends on the country. Forex brokers need to be licensed and adhere to specific standards. It’s worth noting that forex is decentralized, operating over-the-counter (OTC) without a central exchange, yet regulations ensure a certain level of transparency.

Key Difference: Stocks are the most regulated, providing a structured environment, while crypto operates in a more free-form, decentralized market. Forex sits somewhere in between, with significant regulation but decentralized trading across global banks.

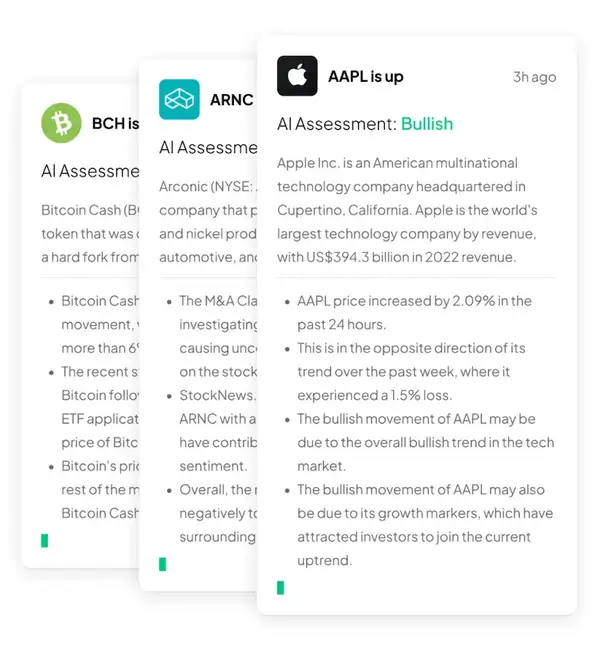

This year, events like the approval of Ethereum and Bitcoin ETFs by the SEC have shown how quickly regulation updates can impact asset prices. To make informed trading decisions, you need to stay on top of the latest developments across all markets—forex, stocks, and crypto. Keeping up with it all can feel overwhelming, but Morpher AI is here to help. With real-time, reliable market data and forecasts for forex, stocks, and cryptocurrencies, Morpher AI ensures you're always ready to react.

2. Trading Hours

Stocks

Stock market trading hours are limited. The majority of stock exchanges, like the NYSE or LSE, operate during business hours (9:30 AM to 4:00 PM, for example). While after-hours trading exists, it’s less liquid, and prices can be more volatile.

Crypto

Cryptocurrency markets never sleep—they’re open 24/7. Whether it’s a weekday or weekend, traders can access the crypto market at any time. This constant availability is both a blessing and a curse, as it requires traders to stay on their toes and can lead to burnout.

Forex

The forex market also offers nearly 24-hour trading but only five days a week. Forex trading is divided across time zones—beginning in Sydney, moving through Asia, Europe, and the U.S.—giving traders flexibility to engage at almost any time, depending on the market they are trading.

Key Difference: Crypto offers 24/7 trading, forex provides 24/5 access, and stocks are confined to traditional business hours with limited after-hours opportunities.

3. Volatility and Liquidity

Stocks

While stock prices can be volatile, especially during earnings seasons or in response to economic news, they generally offer more stability than cryptocurrencies. Liquidity is also high, particularly with large-cap stocks, making it easy to enter and exit positions without major price shifts.

Crypto

The cryptocurrency market is known for its extreme volatility. Prices can surge or crash within minutes, driven by news, sentiment, or even large market participants making significant trades. Liquidity can vary greatly depending on the coin. Bitcoin and Ethereum have high liquidity, while smaller altcoins may be harder to trade without affecting the price.

Forex

Forex is considered one of the most liquid markets in the world due to the high volume of daily transactions—trillions of dollars are traded every day. However, volatility depends on the currency pair and economic factors affecting the currencies involved. Major pairs like EUR/USD are relatively stable, while emerging market currencies can be much more volatile.

Key Difference: Crypto markets are the most volatile with varying liquidity, while forex is the most liquid but with controlled volatility in major pairs. Stocks sit between the two, offering moderate volatility and high liquidity, particularly in well-known companies.

4. Market Participants

Stocks

The stock market is dominated by institutional investors like hedge funds, mutual funds, and pension funds, but retail traders also make up a significant portion. These institutional players generally influence the market’s overall direction due to their large-scale buying and selling.

Crypto

In crypto, retail investors currently dominate. The market's relatively low entry barriers attract individual traders from all over the world. Institutional involvement is growing, but the landscape is still skewed towards smaller, individual participants, leading to unique market behaviors and sentiment-driven price movements.

Forex

The forex market is dominated by large institutions, banks, and governments. While retail investors participate, the sheer volume of institutional trading means they don’t have as much influence as they do in crypto or even stocks. Central banks and hedge funds can impact currency prices significantly.

Key Difference: Forex and stocks are heavily influenced by institutional investors, while the crypto market is more driven by retail traders, although this is beginning to shift as institutions take a more active role in crypto.

5. Leverage and Margin Trading

Stocks

Stock trading allows for leverage, but it’s generally more conservative. For example, in the U.S., regulations limit leverage to 2:1 for retail investors. However, traders can increase their exposure using margin accounts, though the risks are higher.

Crypto

Cryptocurrency exchanges often offer significant leverage, sometimes up to 100:1. While this can amplify gains, it can also result in substantial losses, especially in such a volatile market. This high leverage is a double-edged sword and should be approached with caution, particularly by inexperienced traders.

Forex

Forex is well known for offering high leverage, often much higher than stocks but more regulated than crypto. Brokers typically offer leverage of 50:1 or 100:1, depending on the currency pair and jurisdiction. This makes forex attractive to those looking to maximize returns with relatively small capital, but it also heightens risk.

Key Difference: Forex and crypto markets offer significantly higher leverage than stock markets, making them appealing but risky. Crypto's unregulated high leverage can be particularly dangerous, while forex leverage is more controlled but still impactful.

6. Market Drivers

Stocks

Stock prices are influenced by a combination of company-specific factors (earnings, leadership changes, product launches) and broader economic factors (interest rates, inflation, and economic reports). Market sentiment also plays a role, but it's often tied to tangible financial metrics.

Crypto

Cryptocurrency prices are driven largely by market sentiment, news, and speculation. Major announcements, like regulatory changes or adoption by large companies, can move prices dramatically. Since cryptocurrencies don’t have traditional financial metrics like earnings reports, their valuation is much more abstract and speculative.

Forex

Currencies are driven primarily by macroeconomic factors. Interest rates, inflation, unemployment rates, and geopolitical events all influence currency values. Central banks and government policies play a crucial role in forex market movements.

Key Difference: Stock prices are often tied to company-specific financial performance, while crypto prices rely heavily on sentiment and speculative news. Forex is primarily influenced by economic policies and geopolitical events.

FAQ

What is the primary difference between stock, forex, and crypto trading?

The fundamental difference lies in the assets traded: stocks represent ownership in companies, forex involves currency pairs, and cryptocurrencies are digital assets. Each varies in volatility, trading hours, and regulatory scrutiny.

Which trading type is best for beginners?

Stock trading is often recommended for beginners due to its regulatory environment and the abundance of research tools. However, the choice also depends on individual risk tolerance and interest in different markets.

How can I manage risks when trading?

Effective risk management strategies include diversifying your portfolio, setting stop-loss levels, and being disciplined about following your trading plan. Understanding and using leverage carefully is also crucial, especially in forex and crypto trading.

In conclusion, knowing the distinctions and implications of stock, forex, and cryptocurrency trading is essential for making informed decisions in the financial world. Each trading type presents unique opportunities and challenges. By assessing your financial goals and risk tolerance, you can choose the market that aligns best with your trading style.

Ready to Trade Across Markets?

On Morpher, you can seamlessly trade stocks, cryptocurrencies, and forex—all from a single platform. Take advantage of fractional trading, endless liquidity, and zero commission trading. Whether you're looking to diversify your portfolio or focus on a specific asset class, Morpher offers everything you need to trade smarter. Start trading today and experience x10 leverage with the flexibility and power that only Morpher provides.

To trade all markets on Morpher, sign up now and enjoy Welcome Bonus!

Disclaimer: All investments involve risk, and the past performance of a security, industry, sector, market, financial product, trading strategy, or individual’s trading does not guarantee future results or returns. Investors are fully responsible for any investment decisions they make. Such decisions should be based solely on an evaluation of their financial circumstances, investment objectives, risk tolerance, and liquidity needs. This post does not constitute investment advice.

Painless trading for everyone

Hundreds of markets all in one place - Apple, Bitcoin, Gold, Watches, NFTs, Sneakers and so much more.

Painless trading for everyone

Hundreds of markets all in one place - Apple, Bitcoin, Gold, Watches, NFTs, Sneakers and so much more.