The Importance of Lagging Indicators in Economic Analysis

As an expert in the field of economic analysis, I cannot stress enough the importance of lagging indicators in understanding and predicting economic trends. While leading indicators serve as a glimpse into the future, lagging indicators provide essential confirmation and context, helping economists and policymakers make informed decisions. In this article, we will delve into the world of lagging indicators, explore their definition, types, and significance, as well as examine the interplay between leading and lagging indicators. We will also address the challenges in using these indicators and discuss future perspectives on their analysis.

Understanding Lagging Indicators

Before we dive deeper, let us start by defining and exploring the role of lagging indicators. Lagging indicators are economic data points that change after the economy has already begun to shift. Unlike leading indicators, which provide early signals of potential changes, lagging indicators reflect past economic performance. These indicators are crucial in confirming trends and validating the accuracy of economic forecasts.

When we delve into the realm of lagging indicators, we uncover a fascinating layer of economic analysis that sheds light on the intricate workings of market dynamics. These indicators serve as a retrospective lens through which we can examine the ripples of economic decisions and external factors that have shaped the current state of affairs. By understanding lagging indicators, we gain a deeper appreciation for the interconnectedness of economic variables and the complexities of forecasting future trends.

Definition and Role of Lagging Indicators

Lagging indicators offer valuable insights into the health and stability of an economy by examining the aftermath of economic changes. They act as an accountability measure, allowing economists and policymakers to assess the effectiveness of various economic policies and strategies.

Moreover, lagging indicators play a crucial role in providing a comprehensive narrative of economic performance over time. By analyzing these indicators, experts can trace the evolution of economic trends and identify patterns that offer valuable lessons for future decision-making. The retrospective nature of lagging indicators adds a layer of depth to economic analysis, enabling stakeholders to gain a holistic understanding of the forces at play in the market.

Types of Lagging Indicators

There are various types of lagging indicators, each providing a different perspective on economic performance. Some common lagging indicators include GDP (Gross Domestic Product) growth rates, unemployment rates, inflation rates, and corporate earnings reports. These indicators provide a historical lens through which we can analyze the state of the economy.

Delving into the specifics of each type of lagging indicator unveils a rich tapestry of economic data that offers nuanced insights into different facets of the market. From the fluctuations in GDP growth rates that reflect the overall economic output of a country to the unemployment rates that gauge labor market conditions, each indicator contributes a unique piece to the puzzle of economic analysis. By examining these lagging indicators in conjunction with leading and coincident indicators, economists can construct a comprehensive picture of the economic landscape, enabling informed decision-making and strategic planning.

The Significance of Lagging Indicators in Economic Analysis

Now that we understand what lagging indicators are, let us explore their significance in economic analysis.

Predicting Economic Trends with Lagging Indicators

While lagging indicators may not provide early signals of economic changes, they are crucial for predicting and understanding long-term trends. By analyzing trends in lagging indicators such as GDP growth rates and unemployment rates, analysts can identify patterns and make informed predictions about the future trajectory of the economy. This data helps economists guide businesses, governments, and individuals in making strategic decisions.

Lagging Indicators and Economic Policy Making

Economic policymakers rely on lagging indicators to assess the effectiveness of their policy decisions. By analyzing lagging indicators, policymakers can evaluate the impact of previous policies and adjust their approaches accordingly. This data-driven approach allows for informed decision-making and ensures that economic policies align with the observed reality.

The Interplay Between Leading and Lagging Indicators

The relationship between leading and lagging indicators is a nuanced one, and understanding their interplay is essential for comprehensive economic analysis.

Contrasting Leading and Lagging Indicators

While leading indicators provide early signals of potential changes, lagging indicators confirm these changes and provide historical context. Leading indicators act as a guidepost, pointing towards potential shifts in the economy, while lagging indicators offer validation and a more complete picture of economic performance. Both types of indicators are essential for a comprehensive understanding of the economic landscape.

The Balance of Leading and Lagging Indicators in Comprehensive Analysis

By combining leading and lagging indicators, economists can gain a well-rounded perspective on the economy. Leading indicators offer forward-looking insights, while lagging indicators provide verifiable evidence of economic trends. Striking the right balance between these indicators is crucial for accurate economic forecasting and policy decision-making.

Challenges in Using Lagging Indicators

While lagging indicators are invaluable in economic analysis, they do come with their fair share of challenges that economists must navigate.

Timing Issues with Lagging Indicators

One of the main challenges with lagging indicators is the time lag between the occurrence of economic changes and the availability of data. It takes time for economic data to be collected, processed, and reported. This delay can impact the timely analysis of economic trends and pose challenges in making real-time decisions.

Misinterpretations and Misuse of Lagging Indicators

Lagging indicators, like any other data, can be prone to misinterpretation and misuse. Analysts must approach these indicators with caution and consider them alongside other economic factors. Failing to do so may result in skewed conclusions and flawed policy decisions.

Future Perspectives on Lagging Indicators

The field of lagging indicator analysis continues to evolve, driven by advancements in technology and data analytics. These advancements promise new opportunities and challenges for economists and analysts.

Innovations in Lagging Indicator Analysis

The emergence of big data and advanced analytical techniques unlocks new possibilities for analyzing lagging indicators. By harnessing large volumes of data and employing sophisticated models, economists can gain deeper insights into economic performance, leading to more accurate predictions and enhanced decision-making.

The Evolving Role of Lagging Indicators in Global Economics

With the interconnectedness of the global economy, the role of lagging indicators is becoming increasingly important. Understanding how lagging indicators vary across countries and regions can provide valuable insights into the global economic landscape. As global economic dynamics continue to evolve, lagging indicators will play a pivotal role in driving strategic decision-making on a global scale.

Conclusion

In conclusion, lagging indicators are undeniably important in economic analysis. They offer valuable confirmation, context, and historical validation in understanding economic trends. By effectively utilizing and interpreting lagging indicators, economists and policymakers can make informed decisions that shape the economic future. As the field of economic analysis continues to evolve, it is imperative that we embrace the potential of lagging indicators and leverage their insights to navigate the complex world of global economics.

Frequently Asked Questions

What are lagging indicators?

Lagging indicators are economic data points that change after the economy has already shifted, reflecting past economic performance.

Why are lagging indicators important?

Lagging indicators provide confirmation and context, helping economists and policymakers make informed decisions and validate economic forecasts.

How do lagging indicators differ from leading indicators?

While leading indicators provide early signals of potential changes, lagging indicators confirm these changes and provide historical context.

What are the challenges in using lagging indicators?

Timing issues and the potential for misinterpretation and misuse are among the challenges associated with lagging indicators.

What is the future of lagging indicator analysis?

The future of lagging indicator analysis lies in leveraging advancements in technology and data analytics, providing opportunities for enhanced insights and more accurate predictions.

Dear reader, I have devoted my career to researching and understanding the intricate world of economic indicators. I vividly recall encountering a situation in my early years where the unemployment rate dropped significantly, indicating a flourishing economy. The leading indicators were also positive, pointing towards further growth. However, when I delved into the lagging indicators, I discovered that the GDP growth rate was stagnant, revealing a disconnect between job creation and actual economic performance. This eye-opening experience was a valuable lesson in the power of lagging indicators. It reinforced the essential role they play in validating economic trends and guiding decision-making.Remember, when analyzing economic indicators, it is crucial to consider a comprehensive range of factors, including both leading and lagging indicators. This holistic approach will enable you to navigate the complex world of economic analysis with confidence and make informed decisions based on a solid foundation of data.If you have any more questions or would like to discuss further, feel free to reach out. I am here to assist you on your journey to mastering the art of economic analysis.

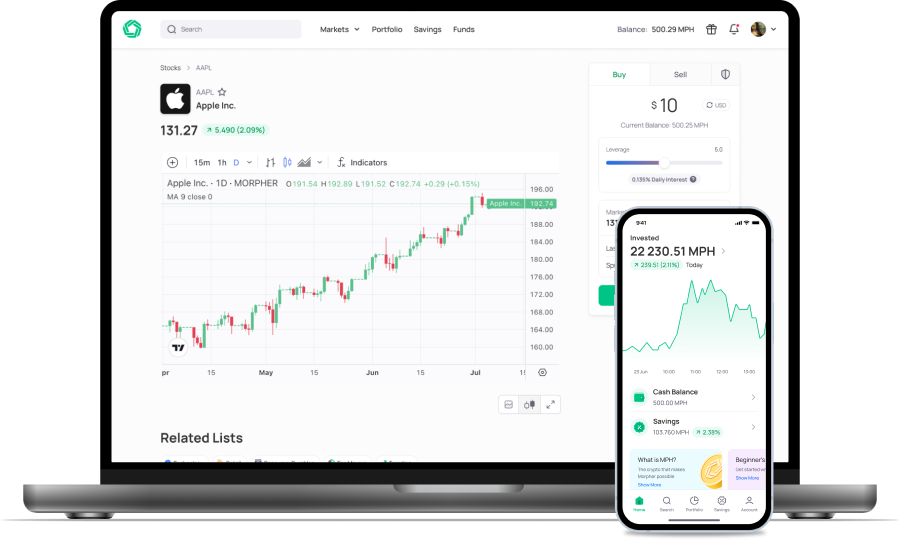

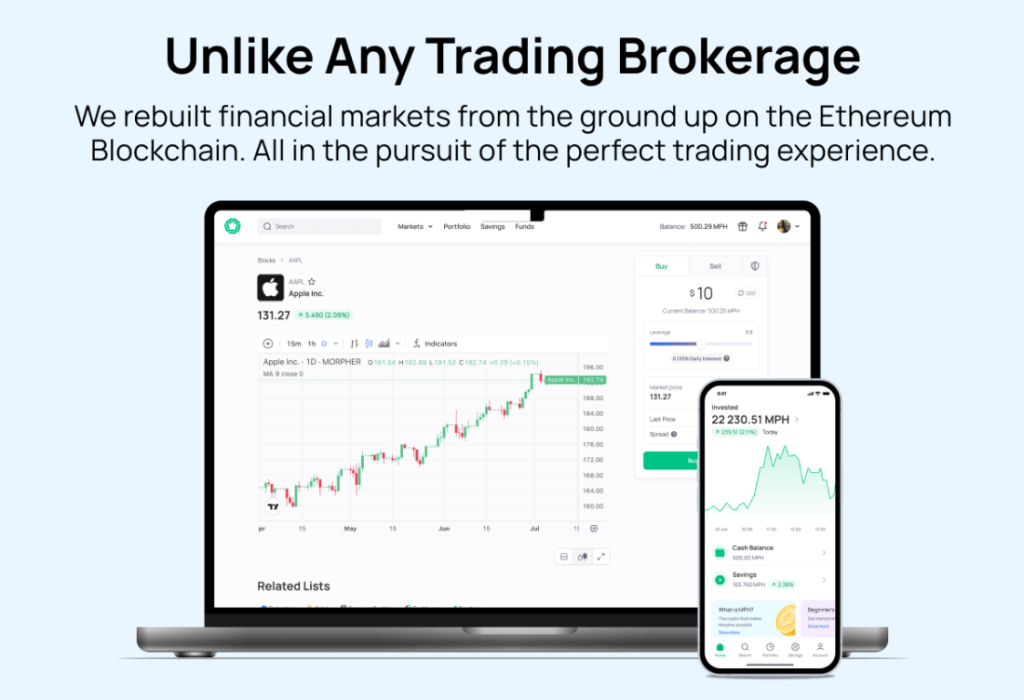

As you continue to explore the significance of lagging indicators in economic analysis, consider the innovative platform Morpher offers for your trading journey. Morpher.com revolutionizes investing by integrating blockchain technology, providing zero fees, infinite liquidity, fractional investing, and the safety of a non-custodial wallet. Whether you're looking to leverage up to 10x on trades or engage in short selling across diverse markets, Morpher caters to all your investment needs. Embrace the future of trading with a unique experience that aligns with the insights gained from your economic analysis. Sign Up and Get Your Free Sign Up Bonus today to transform the way you trade.

Disclaimer: All investments involve risk, and the past performance of a security, industry, sector, market, financial product, trading strategy, or individual’s trading does not guarantee future results or returns. Investors are fully responsible for any investment decisions they make. Such decisions should be based solely on an evaluation of their financial circumstances, investment objectives, risk tolerance, and liquidity needs. This post does not constitute investment advice.

Painless trading for everyone

Hundreds of markets all in one place - Apple, Bitcoin, Gold, Watches, NFTs, Sneakers and so much more.

Painless trading for everyone

Hundreds of markets all in one place - Apple, Bitcoin, Gold, Watches, NFTs, Sneakers and so much more.