Guide to Solana ETF Approval 2024: Crypto’s Next Big Thing

2024 has been pivotal for crypto adoption, especially among mainstream and institutional investors. The year began with the groundbreaking approval of Bitcoin ETFs in early January, setting a precedent for the crypto industry. Shortly after, Ethereum ETFs followed suit, initially facing skepticism but ultimately receiving the green light from the SEC. Now, all eyes are on the potential approval of Solana ETFs, which is expected to be the next significant milestone in the crypto world.

This comprehensive guide by Morpher aims to equip you with all the essential information about Solana ETFs. We will examine the current status of Solana ETF approvals, the potential impact on the market, and the fundamentals of ETFs as an investment vehicle. Whether you're a seasoned investor or new to the crypto space, this guide will provide valuable insights to help you navigate the evolving landscape of crypto investments.

What is Solana?

Solana is a high-performance blockchain platform designed for decentralized applications (dApps) and scalable cryptocurrency transactions. Founded by Anatoly Yakovenko in 2017, Solana differentiates itself by its blazing-fast transaction speeds and low fees. With its innovative architecture, Solana can process thousands of transactions per second, making it a powerful contender in the blockchain arena.

Solana's blockchain technology utilizes a unique approach called Proof of History (PoH) combined with Proof of Stake (PoS). PoH timestamps each transaction, creating a transparent and verifiable ordering of events. This enhances security and eliminates the need for resource-intensive consensus algorithms. Validators hold Solana tokens (SOL) to validate and confirm transactions, ensuring fast and efficient processing.

Will Solana ETFs Get Approved?

The approval of Solana ETFs is currently a topic of significant discussion and speculation within the crypto community. Several factors play a crucial role in determining whether Solana ETFs will receive regulatory approval.

Regulatory Hurdles

One of the primary challenges facing the approval of Solana ETFs is the absence of a regulated futures market for Solana. Unlike Bitcoin and Ethereum, which have futures products listed on major U.S. exchanges such as CME and CBOE, Solana has not yet achieved this milestone. This lack of a regulated futures market is a substantial barrier that could take years to overcome.

Additionally, the U.S. Securities and Exchange Commission (SEC) has classified Solana as a security, complicating the approval process. This classification presents a major obstacle, as Bitcoin and Ethereum, which have successfully gained ETF approval, are not designated as securities by the SEC.

Industry Sentiment and Market Conditions

Despite these regulatory challenges, there is optimism within the industry. Analysts from VanEck and other firms have expressed hope that a change in U.S. political leadership could lead to a more favorable regulatory environment for crypto ETFs. If there is a shift in the administration, it might pave the way for Solana ETF approval.

Market sentiment has also been positive, with Solana's strong market presence and growing adoption making it a prime candidate for ETF approval. The recent approval of Ethereum ETFs has fueled speculation that Solana could be next in line, given its reputation as an “Ethereum killer” and its significant market cap of over $66 billion.

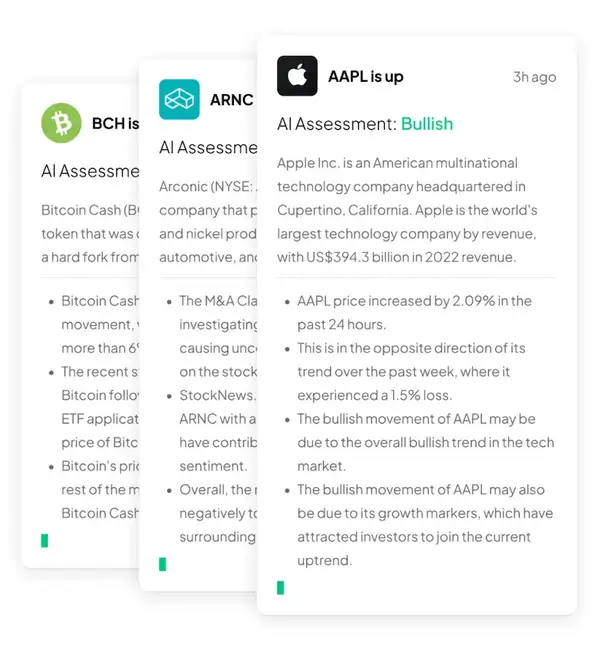

For the latest updates and in-depth analysis, visit the Morpher AI Solana Market Insights page. Morpher AI offers real-time market insights, AI-driven analytics, customizable alerts, and detailed reports to help you stay ahead in the crypto market. Stay informed and make smarter investment decisions with Morpher AI!

Potential Timeline

While it is difficult to predict the exact timeline for Solana ETF approval, some industry experts believe it could happen within the next few years. The approval of Bitcoin and Ethereum ETFs has set a precedent, and as regulatory frameworks continue to evolve, the path for Solana ETFs may become clearer. However, it is likely that the approval process will depend heavily on future political and regulatory developments.

In conclusion, while Solana ETFs have not yet been approved, the ongoing interest and developments in the regulatory landscape suggest that they could become a reality in the near future. Investors should stay informed about the latest updates and be prepared for the potential impact of Solana ETFs on the market.

The Concept of ETFs

What are ETFs?

ETF stands for Exchange-Traded Fund, a type of investment fund traded on stock exchanges. Unlike mutual funds, which are priced once a day at market close, ETFs are traded throughout the day at prices that fluctuate in real-time. ETFs are designed to track the performance of a specific index, sector, or asset class, providing investors with diversified exposure to a range of underlying assets.

Now, you might be curious about the benefits of investing in ETFs. Let's explore them next!

The Benefits of Investing in ETFs

One of the key advantages of investing in ETFs is their diversification. By holding a single ETF, you gain exposure to a broad range of assets, which helps spread risk. Additionally, ETFs offer flexibility in buying and selling throughout the trading day, providing investors with liquidity.

Moreover, ETFs often have lower expense ratios compared to mutual funds, making them cost-effective investment options. Furthermore, ETFs offer tax efficiencies by minimizing capital gains distributions, which can be particularly advantageous for long-term investors.

However, like any investment, there are risks associated with ETFs. Let's explore them in the next section!

Risks Associated with ETFs

While ETFs offer numerous benefits, it's crucial to understand the risks involved. One significant risk is market volatility. If the underlying assets of the ETF experience substantial price fluctuations, the value of the ETF can also decline.

Liquidity risk is another potential concern. Although ETFs are traded on exchanges, not all ETFs have high trading volumes. Low liquidity can result in wider spreads between the buying and selling price, thus affecting the execution price for investors.

It's important to carefully assess your risk tolerance and investment goals before diving into the world of ETFs. Now, let's explore how Solana and ETFs intersect.

The Intersection of Solana and ETFs

The Emergence of Solana ETFs

Given Solana's rising popularity and its unique blockchain capabilities, it comes as no surprise that Solana ETFs are emerging in the market. Solana ETFs are investment vehicles that allow investors to gain exposure to Solana's performance without directly owning the underlying cryptocurrency.

How Solana ETFs Operate

Solana ETFs operate similarly to other ETFs, offering investors diversified exposure to Solana's performance. These ETFs invest in a basket of Solana-related assets, such as SOL tokens, projects built on the Solana blockchain, or companies heavily involved in the Solana ecosystem.

The beauty of Solana ETFs is that they provide investors with a hassle-free way to gain exposure to Solana's potential returns without the complexities of purchasing and storing cryptocurrencies.

Now, let's explore what factors you should consider before investing in Solana ETFs.

Investing in Solana ETFs

Factors to Consider Before Investing

Prior to investing in Solana ETFs, it's essential to conduct thorough research and consider a few key factors. First and foremost, evaluate the ETF's expense ratio and compare it with similar ETFs in the market. Lower expense ratios can significantly impact your long-term returns.

Secondly, analyze the ETF's holdings to ensure that it aligns with your investment goals. Understanding the composition and weightage of underlying assets can provide insights into the ETF's risk profile and potential returns.

Lastly, consider the ETF provider's reputation, track record, and regulatory compliance. Investing in ETFs offered by reputable and established providers can provide additional confidence in your investment decision.

Now that you know what to consider let's move on to the steps involved in investing in Solana ETFs.

Steps to Invest in Solana ETFs

Investing in Solana ETFs is a straightforward process. Here are the basic steps you need to follow:

- Open an investment account with a brokerage or investment platform that offers Solana ETFs.

- Complete the necessary documentation required for account setup.

- Research available Solana ETF options and compare their expense ratios, holdings, and provider reputations.

- Select the Solana ETF that aligns with your investment goals.

- Enter the desired amount to invest and execute the trade through your brokerage account.

- Monitor the performance of your Solana ETF and make necessary adjustments to your investment strategy as needed.

Potential Returns and Risks

As with any investment, the potential returns of Solana ETFs depend on various factors, including Solana's performance, market conditions, and the ETF's underlying assets. If Solana continues to thrive and gain adoption, Solana ETFs have the potential to generate attractive returns for investors.

However, it's important to acknowledge the risks as well. Market volatility, regulatory changes, and technological uncertainties can all impact the performance of Solana ETFs. As an investor, it's crucial to stay informed about the latest developments and to carefully evaluate the risks before making investment decisions.

That brings us to the end of our ultimate guide to Solana ETFs. I hope this comprehensive article has provided you with valuable insights into Solana, ETFs, and the exciting intersection between the two. As an expert in the field, I highly encourage you to thoroughly research and consider your investment goals before diving into Solana ETFs.

Frequently Asked Questions (FAQ)

1. What is Solana?

Solana is a high-performance blockchain platform designed for decentralized applications (dApps) and scalable cryptocurrency transactions. It offers blazing fast transaction speeds and low fees, making it a powerful contender in the blockchain space.

2. What are ETFs?

ETFs (Exchange-Traded Funds) are investment funds that are traded on stock exchanges. They are designed to track the performance of a specific index, sector, or asset class, providing investors with diversified exposure to a range of underlying assets.

3. What are the benefits of investing in ETFs?

Investing in ETFs offers diversification, flexibility, cost-effectiveness, and tax efficiencies. ETFs provide exposure to a broad range of assets, can be traded throughout the day, often have lower expense ratios, and minimize capital gains distributions.

4. What are the risks associated with ETFs?

Risks associated with ETFs include market volatility and liquidity risk. The value of ETFs can decline due to price fluctuations in underlying assets, and low liquidity may result in wider spreads between buying and selling prices.

5. How do Solana ETFs operate?

Solana ETFs operate similarly to other ETFs, offering investors diversified exposure to Solana's performance. They invest in a basket of Solana-related assets, allowing investors to participate in Solana's potential returns without directly owning the underlying cryptocurrency.

6. What factors should I consider before investing in Solana ETFs?

Before investing in Solana ETFs, consider factors such as the expense ratio, holdings, and reputation of the ETF provider. Evaluate the costs, portfolio composition, and the credibility of the ETF issuer to make informed investment decisions.

7. How do I invest in Solana ETFs?

To invest in Solana ETFs, open an investment account with a brokerage or investment platform that offers Solana ETFs. Complete the necessary documentation, research available options, select an ETF, enter the desired investment amount, and execute the trade through your brokerage account.

8. What are the potential returns and risks associated with Solana ETFs?

The potential returns of Solana ETFs depend on factors such as Solana's performance, market conditions, and the ETF's underlying assets. While Solana ETFs have the potential to generate attractive returns, it's crucial to acknowledge the risks associated with market volatility, regulatory changes, and technological uncertainties.

Ready to take your investment journey to the next level with Solana ETFs? Discover the revolutionary trading world at Morpher, where you can leverage the power of blockchain technology to trade a vast array of assets, including Solana, without any fees. With Morpher, you're not just investing; you're joining a platform that offers infinite liquidity, fractional investing, and up to 10x leverage to maximize your potential returns. Sign up today, take control of your investments with the Morpher Wallet, and experience a unique trading environment. Don't miss out – Sign Up and Get Your Free Sign Up Bonus now to begin your journey with Morpher!

Disclaimer: All investments involve risk, and the past performance of a security, industry, sector, market, financial product, trading strategy, or individual’s trading does not guarantee future results or returns. Investors are fully responsible for any investment decisions they make. Such decisions should be based solely on an evaluation of their financial circumstances, investment objectives, risk tolerance, and liquidity needs. This post does not constitute investment advice.

Painless trading for everyone

Hundreds of markets all in one place - Apple, Bitcoin, Gold, Watches, NFTs, Sneakers and so much more.

Painless trading for everyone

Hundreds of markets all in one place - Apple, Bitcoin, Gold, Watches, NFTs, Sneakers and so much more.