What is the Bart Pattern?

Throughout history, patterns have emerged that have captivated the attention of researchers and enthusiasts alike. One such pattern that has gained significant recognition is the Bart Pattern. In this comprehensive analysis, I will delve into the various aspects of this unique phenomenon, from its origin and key characteristics to its practical applications and future prospects.

Understanding the Bart Pattern

Before we venture deeper into the intricacies of the Bart Pattern, let's first gain a solid understanding of what it entails. This pattern is derived from the world of finance, particularly in the context of cryptocurrency markets. Named after the iconic character Bart Simpson, the Bart Pattern refers to a specific price formation that resembles the hairstyle of this famous cartoon character.

Origin and History of the Bart Pattern

The Bart Pattern's origin can be traced back to the volatile cryptocurrency markets, where price movements often exhibit remarkable patterns. As traders observed these recurring formations, the Bart Pattern gradually caught the attention of experts and analysts. While it initially gained popularity in the cryptocurrency realm, its principles can be applied to various financial markets.

But how did this peculiar pattern come to be associated with Bart Simpson? The answer lies in the uncanny resemblance between the price movements and the iconic hairstyle of the mischievous cartoon character. Just like Bart's hair shoots up in a sharp curve and then drops abruptly, the Bart Pattern displays a similar trajectory in the financial charts.

Key Characteristics of the Bart Pattern

One of the fundamental characteristics of the Bart Pattern is its distinctive shape. It typically consists of a sharp upward movement, followed by a rapid decline in price, resembling the upward curve and subsequent drop of Bart Simpson's hairstyle. This pattern often occurs within a short timeframe, making it imperative for traders and investors to stay vigilant and react swiftly.

However, there is more to the Bart Pattern than just its shape. Another key characteristic is the volume profile associated with this pattern. Generally, the volume tends to be relatively high during the upward movement, indicating increased market activity and participation. This surge in volume reflects the excitement and enthusiasm of traders as they ride the upward wave of the Bart Pattern.

Yet, as the price plunges, the volume tends to dissipate, suggesting a decline in interest and potential exhaustion of the pattern. This decrease in volume signifies a loss of momentum and a shift in market sentiment. Traders and investors need to be aware of this change and adjust their strategies accordingly.

Theoretical Framework of the Bart Pattern

To truly comprehend the Bart Pattern, it is essential to explore its underlying principles and concepts, as well as its mathematical representation.

Underlying Principles and Concepts

At its core, the Bart Pattern embodies the principles of market psychology and behavioral finance. It reflects the collective actions and sentiments of market participants, influenced by factors such as fear, greed, and market manipulation. Understanding these psychological aspects can provide valuable insights into the formation and potential outcomes of the Bart Pattern.

Mathematical Representation of the Bart Pattern

While the Bart Pattern may seem subjective due to its qualitative nature, it can also be represented mathematically through various technical analysis tools. These tools utilize mathematical formulas and algorithms to identify and analyze patterns in price data. By applying these mathematical representations, traders can enhance their decision-making process and potentially capitalize on the Bart Pattern's predictability.

Practical Applications of the Bart Pattern

Now that we have delved into the theoretical aspects of the Bart Pattern, let's explore its practical applications in financial markets and beyond.

Use in Financial Markets

The Bart Pattern has gained significance within the realm of financial markets, particularly in the cryptocurrency space. Traders and investors closely monitor this pattern as it can offer lucrative opportunities for profit. By identifying the Bart Pattern early on and deploying suitable trading strategies, market participants can potentially benefit from its predictable price movements.

Role in Data Analysis and Predictive Modeling

The Bart Pattern also holds relevance in the field of data analysis and predictive modeling. By incorporating historical price data and applying sophisticated statistical and machine learning techniques, researchers and analysts can develop models to predict the occurrence and outcomes of the Bart Pattern. This knowledge can provide valuable insights for making informed decisions and managing risks.

Critiques and Limitations of the Bart Pattern

As with any analytical tool or pattern, the Bart Pattern is not exempt from critiques and limitations. It is crucial to understand the potential drawbacks and misinterpretations associated with this pattern.

Potential Drawbacks and Misinterpretations

One of the primary concerns with the Bart Pattern is its subjective interpretation. Due to its resemblance to Bart Simpson's hairstyle, some critics argue that it may be a mere coincidence rather than a meaningful pattern. It is important for analysts to exercise caution and not solely rely on the Bart Pattern for making trading decisions.

Moreover, the Bart Pattern's efficacy can vary across different market conditions and assets. It may perform well in specific scenarios but might prove less reliable in others. Traders should consider these limitations and conduct thorough analysis before relying solely on the Bart Pattern.

Areas for Further Research and Exploration

Despite its popularity and widespread recognition, there is still much to explore and unravel regarding the Bart Pattern. Areas for further research include studying the pattern's prevalence in different markets, analyzing its correlation with fundamental factors, and developing more advanced predictive models. Continued research and exploration will undoubtedly contribute to a deeper understanding of this intriguing pattern.

Future Prospects of the Bart Pattern

The Bart Pattern has undeniably left a significant mark on the financial landscape. Now, let's explore its potential future prospects and how it aligns with the advancements in modern technology.

Emerging Trends and Developments

With the ongoing advancements in technology, the accessibility of high-frequency trading algorithms and artificial intelligence tools has increased significantly. These developments have the potential to impact the Bart Pattern's prevalence and dynamics. It will be fascinating to observe how these emerging trends shape the future of the Bart Pattern and influence trading strategies.

The Bart Pattern in the Context of Modern Technology

The integration of modern technologies such as blockchain and machine learning opens up exciting possibilities for analyzing and understanding the Bart Pattern. By utilizing advanced algorithms and big data analysis, traders can potentially gain a competitive edge in identifying and acting upon this pattern. The Bart Pattern, alongside modern technology, continues to evolve and redefine the landscape of financial markets.

Frequently Asked Questions (FAQ)

What is the Bart Pattern?

The Bart Pattern is a price formation that resembles the hairstyle of Bart Simpson. It consists of a sharp upward movement followed by a rapid decline, often occurring within a short timeframe. The pattern gained recognition in the cryptocurrency markets but can be observed in various financial markets.

How can the Bart Pattern be applied in financial markets?

The Bart Pattern can be utilized by traders and investors to potentially identify profitable trading opportunities. By recognizing the pattern early on and implementing appropriate trading strategies, market participants can potentially capitalize on its predictability.

What are the limitations of the Bart Pattern?

While the Bart Pattern can be a valuable tool, it is crucial to be aware of its limitations. The pattern's subjective interpretation, potential coincidental resemblance, and varying efficacy across different market conditions are factors traders should consider when utilizing the Bart Pattern.

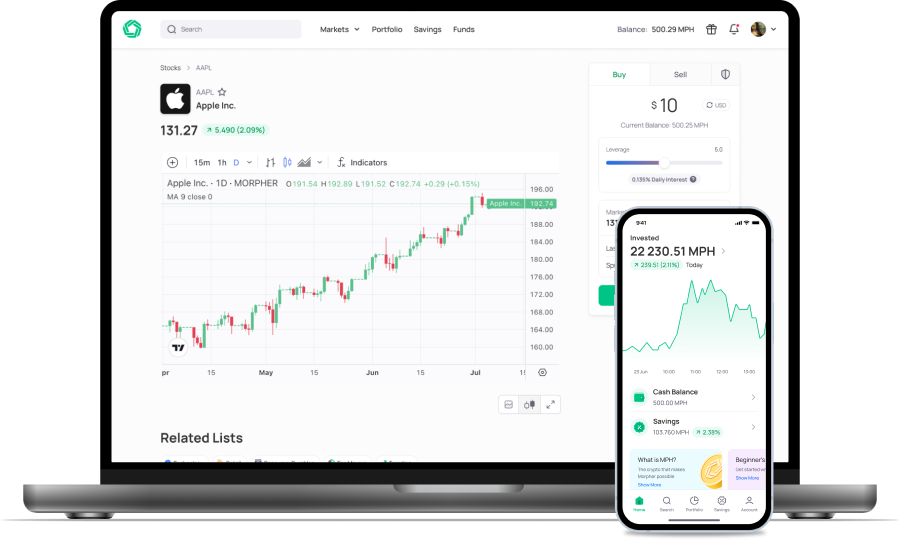

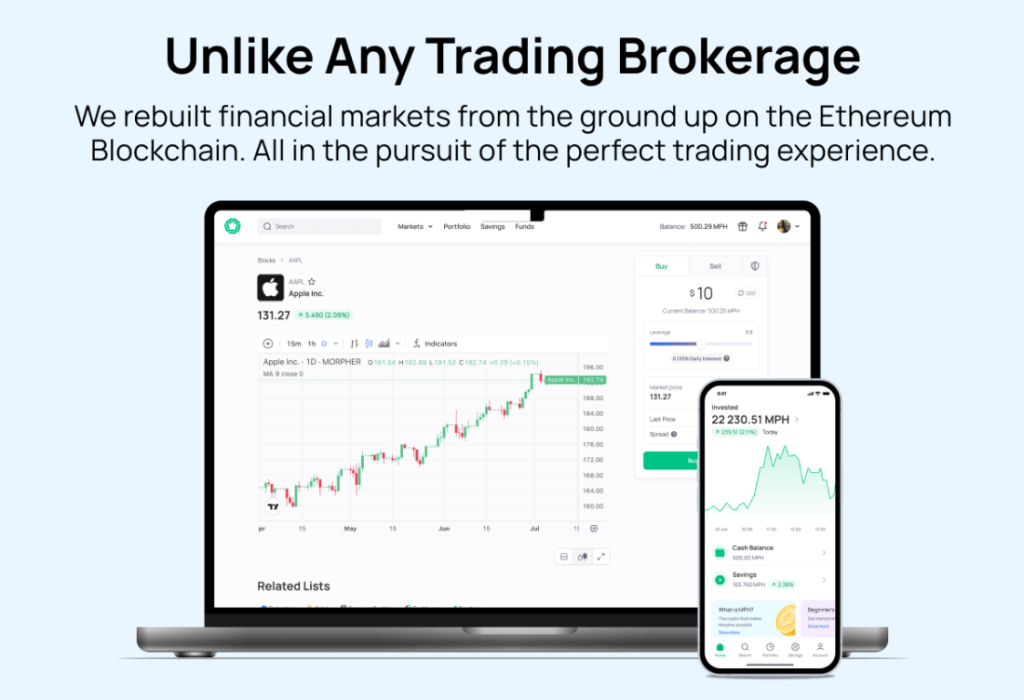

As you explore the dynamic world of financial patterns like the Bart Pattern, it's essential to have a platform that adapts to the evolving markets and empowers your trading decisions. Morpher is precisely that—a revolutionary trading platform that harnesses blockchain technology to offer you a seamless and innovative trading experience. With zero fees, infinite liquidity, and the ability to engage in fractional investing and short selling, Morpher is designed for traders who demand excellence and flexibility. Embrace the future of trading with Morpher's unique Virtual Futures and up to 10x leverage, all while maintaining safety and control over your investments. Ready to transform your trading journey? Sign Up and Get Your Free Sign Up Bonus at Morpher.com and join a community of investors who are reshaping the landscape of investing.

Disclaimer: All investments involve risk, and the past performance of a security, industry, sector, market, financial product, trading strategy, or individual’s trading does not guarantee future results or returns. Investors are fully responsible for any investment decisions they make. Such decisions should be based solely on an evaluation of their financial circumstances, investment objectives, risk tolerance, and liquidity needs. This post does not constitute investment advice.

Painless trading for everyone

Hundreds of markets all in one place - Apple, Bitcoin, Gold, Watches, NFTs, Sneakers and so much more.

Painless trading for everyone

Hundreds of markets all in one place - Apple, Bitcoin, Gold, Watches, NFTs, Sneakers and so much more.