Rosen Law Firm Encourages Carvana Co. Investors to Inquire About Securities Class Action Investigation - CVNA

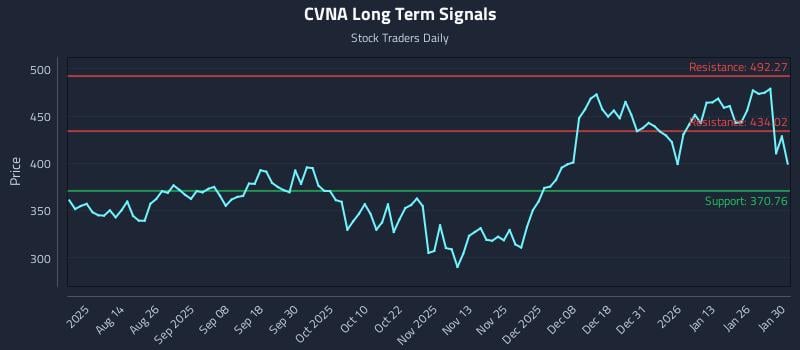

The Rosen Law Firm has announced an investigation into potential securities claims on behalf of Carvana Co. (NYSE: CVNA) shareholders. This follows a Wall Street Journal article alleging Carvana's earnings are overly dependent on private companies linked to its controlling shareholders, which caused a 14% stock price drop. Investors who purchased Carvana securities are encouraged to inquire about joining a prospective class action to recover losses.

https://www.sahmcapital.com/news/content/rosen-law-firm-encourages-carvana-co-investors-to-inquire-about-securities-class-action-investigation-cvna-2026-01-31