Keysight launches AI integrity software for safety‑critical systems

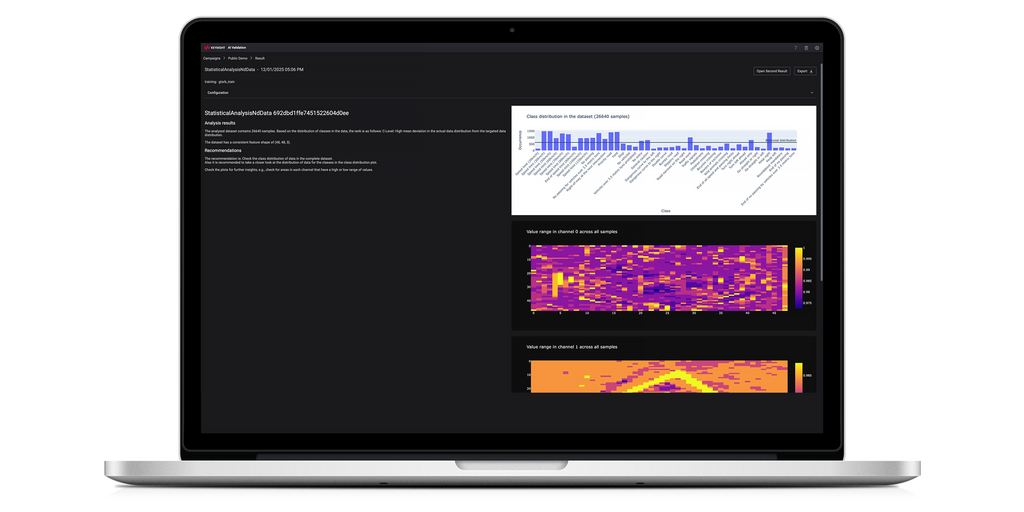

Keysight Technologies has introduced new software, Keysight AI Software Integrity Builder, aimed at improving the validation and long-term reliability of AI systems in safety-critical applications, particularly within the automotive industry. The solution helps engineering teams assess, explain, and monitor AI behavior throughout its lifecycle to meet increasing regulatory requirements and the complexities of AI, providing a unified framework for AI assurance. It addresses challenges like identifying dataset limitations and fragmented testing tools, ensuring AI systems operate safely and comply with standards like ISO/PAS 8800 and the EU AI Act.

https://www.newelectronics.co.uk/content/news/keysight-launches-ai-integrity-software-for-safety-critical-systems