Trading Systems Reacting to (RIOT) Volatility

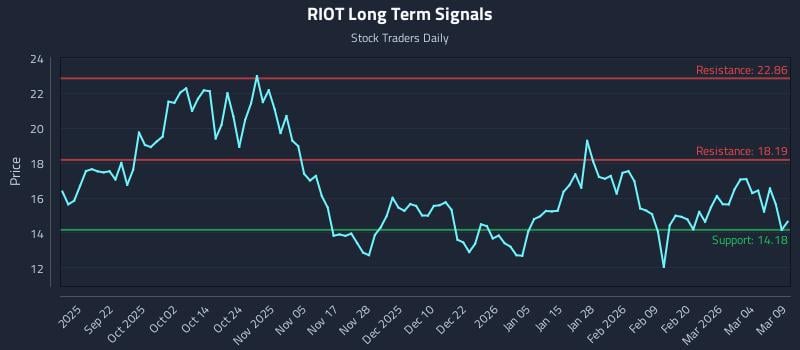

Quantitative Research Desk reports on Riot Platforms Inc. (RIOT) announcing weakness in near-term sentiment opposing long-term strength. This analysis outlines three distinct trading strategies including Position Trading, Momentum Breakout, and Risk Hedging, incorporating sophisticated risk management. The article also provides a multi-timeframe signal analysis with support and resistance levels.

https://news.stocktradersdaily.com/news_release/134/Trading_Systems_Reacting_to_RIOT_Volatility_031026041402_1773130442.html