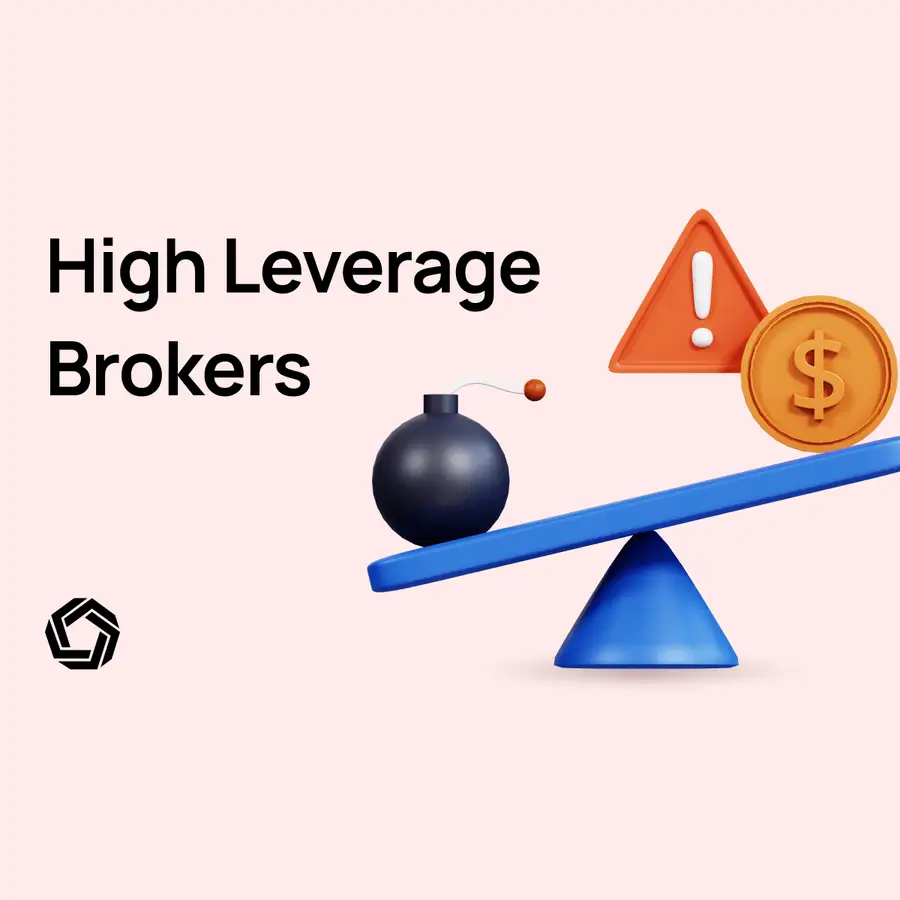

High Leverage Brokers: It’s a Trap, Be Careful

When it comes to trading, leverage can be a powerful tool to increase your potential returns. By borrowing capital, you can enter larger positions than your account balance would typically allow. However, with greater potential for returns also comes greater risk.

High leverage brokers offer the ability to trade with large amounts of borrowed capital, often marketing themselves as the best option to reach big returns. But as we all know, not all that glitters is gold. It's important to be aware of the potential dangers and risks associated with high leverage trading.

In this article, we'll discuss the risks of using high leverage brokers and the ways in which you can protect yourself and make informed decisions when it comes to trading with high leverage.

High Leverage Brokers: Be Aware of the Risks

High leverage brokers have become increasingly popular among traders, especially beginners looking to make big gains with a small amount of capital. These brokers offer extremely high leverage ratios, with some even reaching 1:1000. For traders without experience, this can be a dangerous trap that can lead to huge losses.

Let’s take for example a broker that offers a leverage of 1:1000. This means that for every dollar you put in, the broker will give you $1000 to invest in your trade.

The potential for large returns is certainly attractive, but it also comes with a high risk of losses. Leverage amplifies both profits and losses. This means that if the market moves against you, you can quickly find yourself in a deep hole.

For example, if you were to open a $1000 trade with 1:1000 leverage and the market moves against you by just 1%, you would lose your entire investment. Just like that. Therefore, it's important to be aware of the potential dangers and risks associated with high leverage trading.

On top of that, there are some common misconceptions about high leverage brokers. Many traders assume that the higher the leverage, the better their chances of making money. However, this is not necessarily true. Higher leverage can also lead to larger losses. This combined with a lack of trading experience, it’s a sure way to lose your entire account balance in just a couple of trades.

Risk of Margin Calls

You should also be aware of the risk of margin calls when trading with high leverage. This is when a broker requires you to deposit additional funds to bring it up to the minimum maintenance margin to keep your open positions.

If you fail to meet the margin call requirements, your positions will be closed out automatically by the broker, and you will incur losses.

Risk of Overtrading

When using high leverage in trading, the risk of overtrading becomes a real issue. It often creates a false sense of security, causing traders to feel too confident in their trading decisions because they can trade with more money than they currently have.

Overtrading occurs when a trader takes on too many trades, often with large position sizes, to maximize profits. However, doing this the trader exposes too much of his capital and can lead to heavy losses if the market moves against the trader's position.

Risk of Falling Victim to Fraudulent Brokers

When trading with high leverage brokers, there is always the risk of falling victim to fraudulent brokers. These fraudulent brokers often promise unrealistic returns and use aggressive tactics to convince traders to deposit large sums of money on their platforms. Once they have deposited the money, it can be difficult to withdraw it, and the broker may disappear with the funds.

Therefore, it is crucial for traders to be vigilant and do their due diligence when choosing a broker. This includes reading customer reviews and complaints, and checking the broker's track record for unethical practices. Always be cautious of brokers that offer too-good-to-be-true returns, high leverage, and no KYC requirements, as these are often red flags for fraudulent activities.

Mitigating the Risks When Trading with High Leverage Brokers

To mitigate risks, it is important to understand the dangers of margin calls, overtrading, and falling victim to fraudulent brokers. Here's how you can protect yourself:

Gain Knowledge and Experience

As enticing as high leverage brokers may be, it is important to gain knowledge and experience before trading with them. Ideally, you should only use high leverage to support a winning trade to increase your profits.

A good way to start is by developing a comprehensive risk management plan. This means having a clear understanding of your risk tolerance, setting achievable trading goals, and devising strategies to mitigate potential losses. The main components of a risk management plan include using stop-loss orders, limiting position size, and diversifying your portfolio to diversify the overall risk.

Read the Fine Print

Before depositing funds with a broker, it is essential to read the terms and conditions of the trading agreement. This includes the broker's policy on margin calls, negative balance protection, bonuses and other important details.

Adopt a Low Leverage Approach

One of the most effective ways to reduce risk when trading with high leverage brokers is by adopting a low leverage approach. Start with a low leverage ratio and gradually increase it as your account grows and your confidence and experience level increase. This way, you will be able to maintain a better control over your risk exposure and prevent large losses.

Trading without leverage can also be a suitable option, especially for those just starting out, as it provides several advantages, such as limiting the risk of significant losses and allowing for a more cautious approach to the market.

Conclusion

High leverage brokers can be tempting for traders looking for big returns but come with significant risks including margin calls, overtrading, and falling victim to fraudulent activities. The best way to protect yourself is to educate yourself and create a sound risk management plan before trading with any leverage. Safety first!

Disclaimer: All investments involve risk, and the past performance of a security, industry, sector, market, financial product, trading strategy, or individual’s trading does not guarantee future results or returns. Investors are fully responsible for any investment decisions they make. Such decisions should be based solely on an evaluation of their financial circumstances, investment objectives, risk tolerance, and liquidity needs. This post does not constitute investment advice.

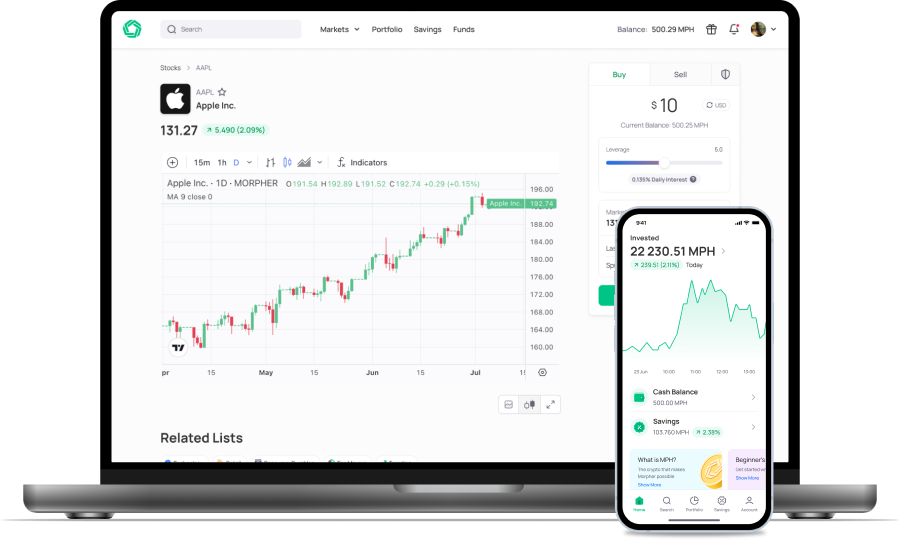

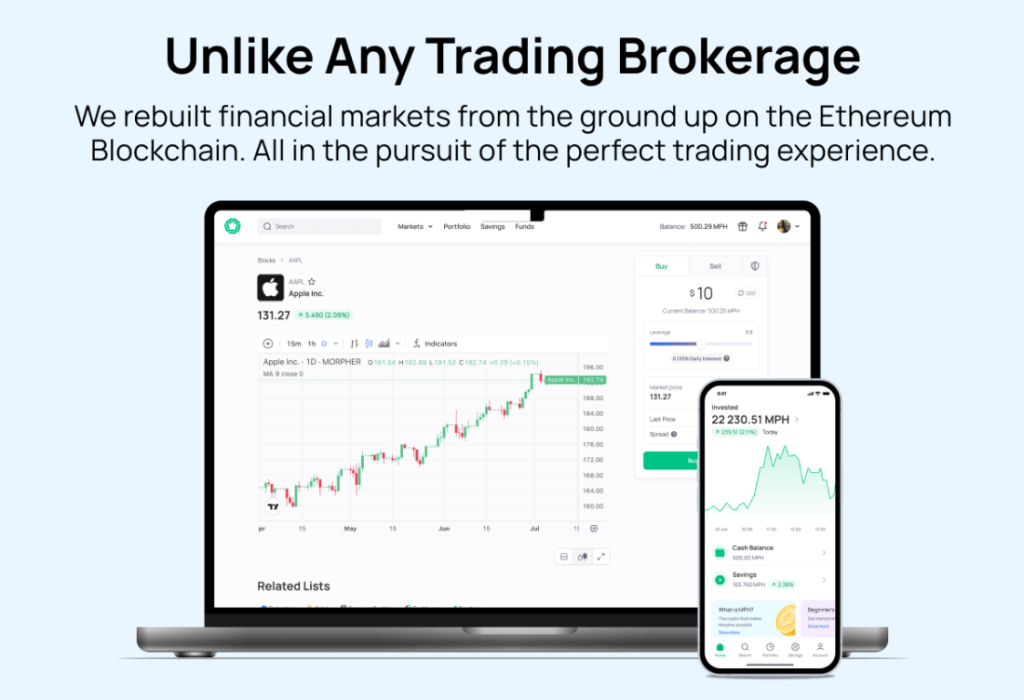

Painless trading for everyone

Hundreds of markets all in one place - Apple, Bitcoin, Gold, Watches, NFTs, Sneakers and so much more.

Painless trading for everyone

Hundreds of markets all in one place - Apple, Bitcoin, Gold, Watches, NFTs, Sneakers and so much more.