What is Swing Trading? How to Do it?

If you're looking to make the most out of your stock investments, then swing trading may just be the strategy for you. In this comprehensive guide, I'll walk you through everything you need to know about swing trading stocks. From understanding the basics to mastering risk management and utilizing the right tools, you'll be well-equipped to take on the exciting world of swing trading.

Understanding Swing Trading

Definition and Basics of Swing Trading

Before diving into the mechanics of swing trading, let's start with the foundation. Swing trading is a trading strategy that aims to capture short-term market trends lasting from a few days to a few weeks. Instead of focusing on long-term investments, swing trading takes advantage of price swings within shorter time frames.

For example, if a stock has been on an upward trend for a few days, a swing trader would aim to buy the stock at a swing low and sell it at a swing high, profiting from the price movement.

Swing trading requires a keen eye for technical analysis and market trends. Traders often utilize various tools and indicators to identify potential entry and exit points for their trades. Moving averages, relative strength index (RSI), and Fibonacci retracement levels are just a few of the many tools in a swing trader's arsenal.

The Philosophy Behind Swing Trading

Swing trading is based on the philosophy that prices tend to move in waves or swings, and by identifying these swings, traders can seize profitable opportunities. This strategy is particularly appealing to those who prefer an active approach to trading and enjoy analyzing charts and market patterns.

As a swing trader, I've personally found that combining technical analysis with a sound understanding of market fundamentals allows me to make informed decisions and increase my chances of success.

Successful swing traders often have a disciplined approach to risk management. Setting stop-loss orders and adhering to predetermined risk-reward ratios are essential practices to protect capital and maximize profits over the long term.

The Mechanics of Swing Trading

Identifying Swing Highs and Lows

One of the key skills in swing trading is the ability to identify swing highs and lows, which are crucial for determining entry and exit points. A swing high occurs when the price of a stock reaches a temporary peak, followed by a decline. On the other hand, a swing low represents a temporary trough followed by an upward movement.

By carefully observing price charts and using technical indicators like moving averages and trend lines, you can effectively spot these swing points and make informed trading decisions.

When identifying swing highs and lows, it's important to consider the concept of market psychology. Swing highs often occur when traders are optimistic about a stock's potential, leading to a peak in prices. Conversely, swing lows are formed when there is pessimism in the market, causing prices to bottom out. Understanding the emotional aspect of trading can provide valuable insights into potential price movements.

Understanding Trading Volume and its Importance

Alongside price analysis, it's essential to consider trading volume when swing trading. Trading volume refers to the number of shares or contracts traded in a specific period. High trading volume often indicates increased market interest and can confirm the validity of a price movement.

Personally, I pay close attention to trading volume when making trading decisions. It helps me gauge market sentiment and confirm that there is sufficient liquidity to support my trades.

Furthermore, analyzing trading volume can also provide clues about potential trend reversals. For example, a price increase accompanied by high trading volume is more likely to be sustained compared to one with low volume, which could indicate a lack of conviction in the market. Understanding the interplay between price movements and trading volume is essential for successful swing trading strategies.

Strategies for Successful Swing Trading

Technical Analysis for Swing Trading

When it comes to swing trading, technical analysis is the bread and butter of successful strategies. By analyzing historical price data, identifying patterns, and using technical indicators, you can gain valuable insights into future price movements.

There is a myriad of technical analysis tools available, including moving averages, Bollinger Bands, and relative strength index (RSI). It's important to find the right combination of indicators that work for you and align with your trading goals.

Fundamental Analysis for Swing Trading

While technical analysis is essential, swing traders should also incorporate fundamental analysis into their strategies. Fundamental analysis involves evaluating a company's financial health, industry trends, and economic factors that may impact stock prices.

As a swing trader, I make it a point to stay updated with relevant news, earnings reports, and economic data releases that may impact the stocks I'm trading. This information helps me make more informed decisions and avoid potential pitfalls.

Risk Management in Swing Trading

Setting Stop Losses and Profit Targets

Risk management is a vital aspect of swing trading. Without proper risk management, even the most successful trades can end up costing you dearly. One of the most effective ways to manage risk is by setting stop-loss orders and profit targets.

Stop-loss orders allow you to limit potential losses by automatically selling a stock if it reaches a predetermined price. On the other hand, profit targets help you secure your gains by automatically selling a stock when it hits a specific price level.

Balancing Risk and Reward in Swing Trading

While it's important to manage risk, swing trading also requires weighing potential rewards. As a swing trader, I constantly evaluate the risk-to-reward ratio of each trade. I aim to find trades with an attractive potential upside while ensuring that the potential downside is manageable.

By practicing disciplined risk management and being selective with my trades, I've been able to minimize losses and maximize profits consistently.

Tools and Resources for Swing Traders

Best Software for Swing Traders

With advancements in technology, there is a wide range of software tools available to assist swing traders. From charting platforms to scanning software, these tools can help identify potential trading opportunities and streamline your analysis process.

Personally, I rely on software that offers comprehensive charting capabilities, real-time data, and customizable technical indicators. This helps me stay on top of market trends and make timely trading decisions.

Essential Books and Blogs for Swing Traders

As a lifelong learner, I've benefited immensely from reading books and following blogs written by seasoned swing traders. These resources often provide valuable insights, trading strategies, and practical tips to improve your swing trading skills.

Some of my favorite swing trading books include “Swing Trading for Dummies” by Omar Bassal and “The Complete Swing Trading System” by Markus Heitkoetter. For online resources, I highly recommend following reputable swing trading blogs such as “SwingTradeBot” and “The Trade Risk” for regular updates and educational content.

FAQ

What is swing trading?

Swing trading is a short-term trading strategy that aims to profit from price swings within a few days to a few weeks. It involves buying stocks at swing lows and selling them at swing highs.

How do I identify swing highs and lows?

To identify swing highs and lows, you need to analyze price charts and look for peaks and troughs. Technical indicators like moving averages and trend lines can also assist in identifying these swing points.

Is swing trading suitable for beginners?

While swing trading can be challenging for beginners due to its active and fast-paced nature, it is certainly possible to learn and excel at swing trading with dedication and the right education. It's recommended to start with a solid understanding of market fundamentals and proper risk management techniques.

What is the best risk management strategy for swing trading?

The best risk management strategy for swing trading is to set stop-loss orders to limit potential losses and profit targets to secure gains. Balancing risk and reward is crucial, and diversifying your portfolio can also help mitigate risks.

What software tools do swing traders use?

Swing traders often use charting platforms, scanning software, and brokerage platforms that provide real-time data and customizable technical indicators. Some popular software options include Thinkorswim, TradeStation, and NinjaTrader.

Can swing traders use fundamental analysis?

Yes, swing traders can benefit from incorporating fundamental analysis into their strategies. Fundamental analysis helps evaluate a company's financial health, industry trends, and other factors that may impact stock prices.

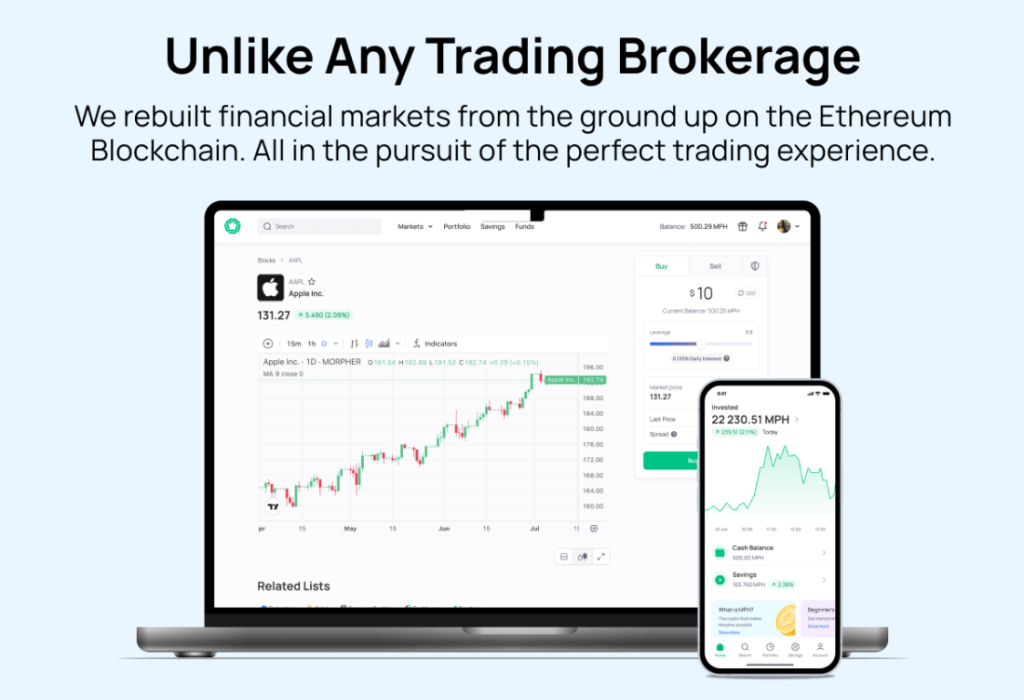

Ready to take your swing trading to the next level with Morpher? Embrace the future of investing on a platform that eliminates trading fees, offers infinite liquidity, and provides the flexibility of fractional investing and short selling. With Morpher, you're not just trading stocks; you're unlocking a world of possibilities across various asset classes, including cryptocurrencies, forex, and even niche markets like NFTs. Experience the safety of a non-custodial wallet, the power of 10x leverage, and the innovation of trading Virtual Futures on the Ethereum Blockchain. Sign Up and Get Your Free Sign Up Bonus today to transform your swing trading journey with Morpher.

Disclaimer: All investments involve risk, and the past performance of a security, industry, sector, market, financial product, trading strategy, or individual’s trading does not guarantee future results or returns. Investors are fully responsible for any investment decisions they make. Such decisions should be based solely on an evaluation of their financial circumstances, investment objectives, risk tolerance, and liquidity needs. This post does not constitute investment advice.

Painless trading for everyone

Hundreds of markets all in one place - Apple, Bitcoin, Gold, Watches, NFTs, Sneakers and so much more.

Painless trading for everyone

Hundreds of markets all in one place - Apple, Bitcoin, Gold, Watches, NFTs, Sneakers and so much more.