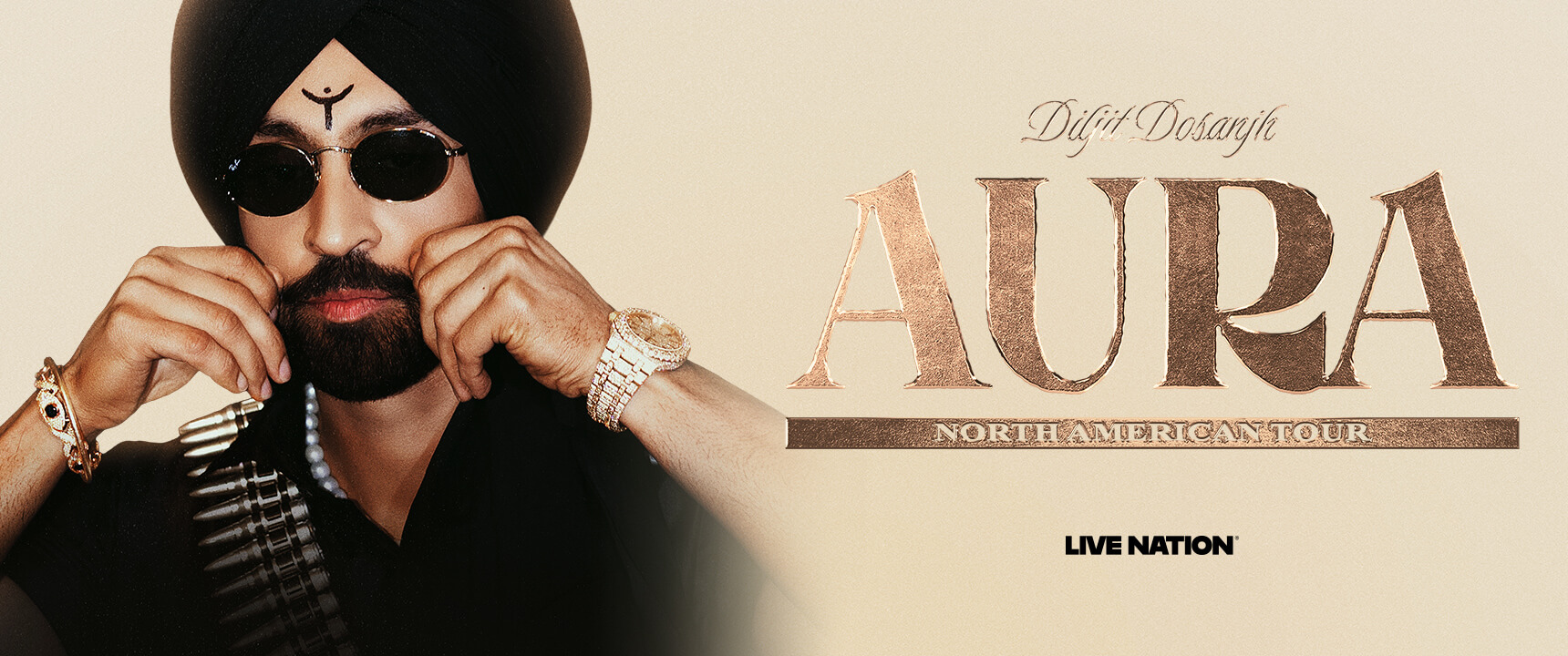

Diljit Dosanjh Returns To Arenas And Stadiums Across North America With The 2026 ‘Aura World Tour’

Global Punjabi superstar Diljit Dosanjh has announced his 2026 Aura World Tour across North America, promoted by Live Nation. This 13-city tour follows his record-breaking 2024 Dil-Luminati Tour and includes stadium performances, kicking off on April 23 at BC Place in Vancouver and concluding on June 20 at Chase Center in San Francisco. Dosanjh continues to make history, having previously been the first Punjabi artist to headline and sell out stadiums in Australia and perform at Coachella, showcasing his significant impact on the global music scene.

https://newsroom.livenation.com/news/diljit-dosanjh-returns-to-arenas-and-stadiums-across-north-america-with-the-2026-aura-world-tour/