(SEDG) Volatility Zones as Tactical Triggers

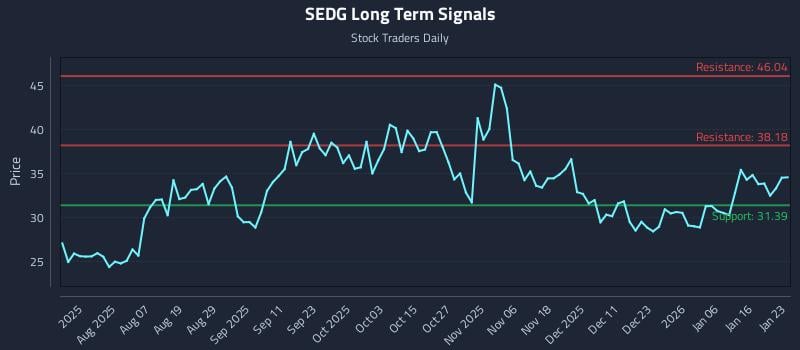

This article analyzes Solaredge Technologies Inc. (NASDAQ: SEDG), highlighting weak near-term sentiment but strong mid and long-term outlooks. It identifies an exceptional risk-reward setup with a potential 21.6% gain and provides AI-generated trading strategies (Position, Momentum Breakout, Risk Hedging) tailored for different risk profiles. The analysis also includes multi-timeframe signal analysis with support and resistance levels.

https://news.stocktradersdaily.com/news_release/22/SEDG_Volatility_Zones_as_Tactical_Triggers_012526033802_1769330282.html