Can Archrock Continue to Bank on Rising Clean Energy Demand?

The demand for cleaner fuel, particularly natural gas, is increasing

https://finviz.com/news/329674/can-archrock-continue-to-bank-on-rising-clean-energy-demand

Morpher AI identified a bullish signal. The stock price may continue to rise based on the momentum of the good news.

APA Corporation (APA) is a company in the energy sector, specifically focusing on oil and gas exploration and production. The stock recorded robust gains today.

APA stock is up 5.2% on Mar 5, 2026 16:40

The demand for cleaner fuel, particularly natural gas, is increasing

https://finviz.com/news/329674/can-archrock-continue-to-bank-on-rising-clean-energy-demand

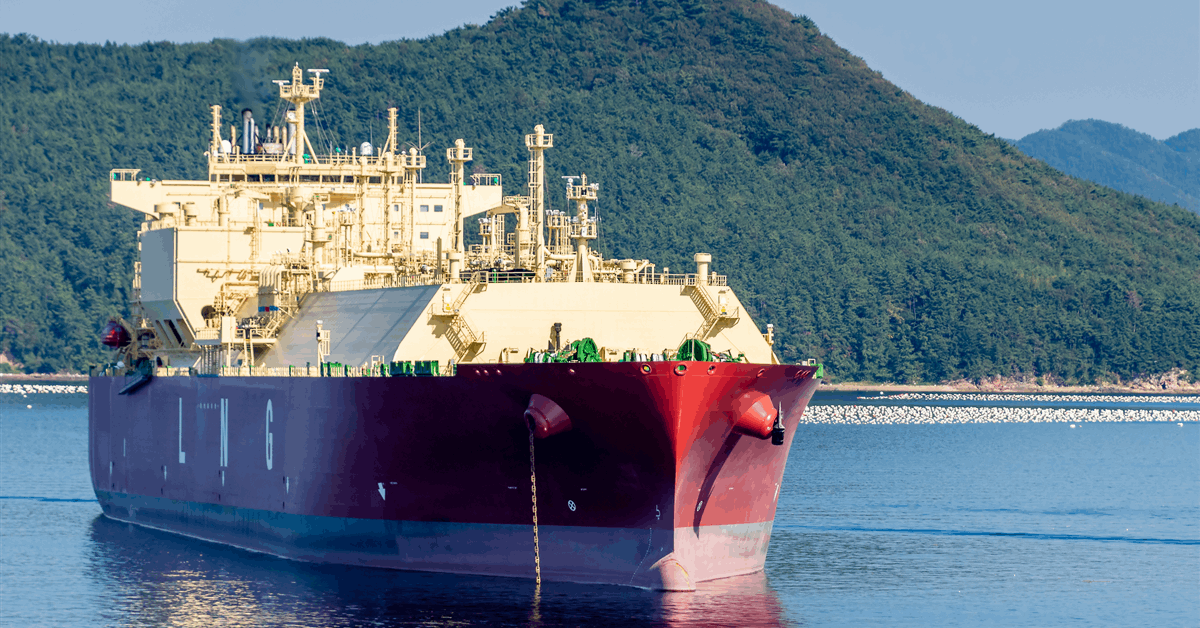

The U.S. Department of Energy has granted Cheniere Energy Inc. non-FTA export authorization for a two-train expansion at its Corpus Christi LNG terminal in Texas. This new permit for Mid-Scale Trains 8 and 9 allows for shipping to countries without a free trade agreement with the U.S. and increases the terminal's total authorized export capacity to 4.45 Bcf/d, making it the second-largest LNG export project in the U.S.

https://www.rigzone.com/news/wire/cheniere_gets_nonfta_permit_for_additional_corpus_christi_lng_trains-04-mar-2026-183129-article/

Jim Cramer highlighted Texas Pacific Land Corporation (NYSE: TPL) as the best-performing S&P 500 stock for February, with a 50.5% gain. The company owns significant land in Texas, leasing it to energy producers and selling water for fracking, making it highly sensitive to crude oil price increases. Cramer also mentioned TPL's long-term potential in building data centers on its land, leveraging natural gas or diesel for power.

https://www.insidermonkey.com/blog/jim-cramer-highlights-texas-pacific-land-as-the-best-performing-sp-500-stock-for-february-1708947/

Delixy Holdings (DLXY) stock surged 158% after hours due to disruptions in oil supply routes near the Strait of Hormuz, caused by conflict in the Middle East. As a Singapore-based oil trader, Delixy's stock saw significant gains alongside rising crude prices, though analysts warn of potential issues like increased shipping and financing costs later on. The company, with a market cap of $13.4 million, is sensitive to such geopolitical events, as demonstrated by the amplified moves in after-hours trading for low-priced stocks.

https://ts2.tech/en/delixy-holdings-dlxy-stock-jumps-158-after-hours-as-hormuz-disruption-rattles-oil-trade/

Fisher Asset Management LLC increased its stake in APA Corporation by 5.2% to 1,449,546 shares, valued at approximately $35.2 million. This comes as APA beat its Q4 earnings estimates with $0.91 EPS and $1.99 billion in revenue, despite a year-over-year revenue decrease. The company also declared a $0.25 quarterly dividend, and analysts generally have a "Hold" rating with some price targets rising into the mid-$30s.

https://www.marketbeat.com/instant-alerts/filing-apa-corporation-apa-stock-position-increased-by-fisher-asset-management-llc-2026-03-04/

Trade Apache Corporation and 700+ other stocks, cryptocurrencies, commodities and more on Morpher. Sign up now and never miss out on the action again!